|

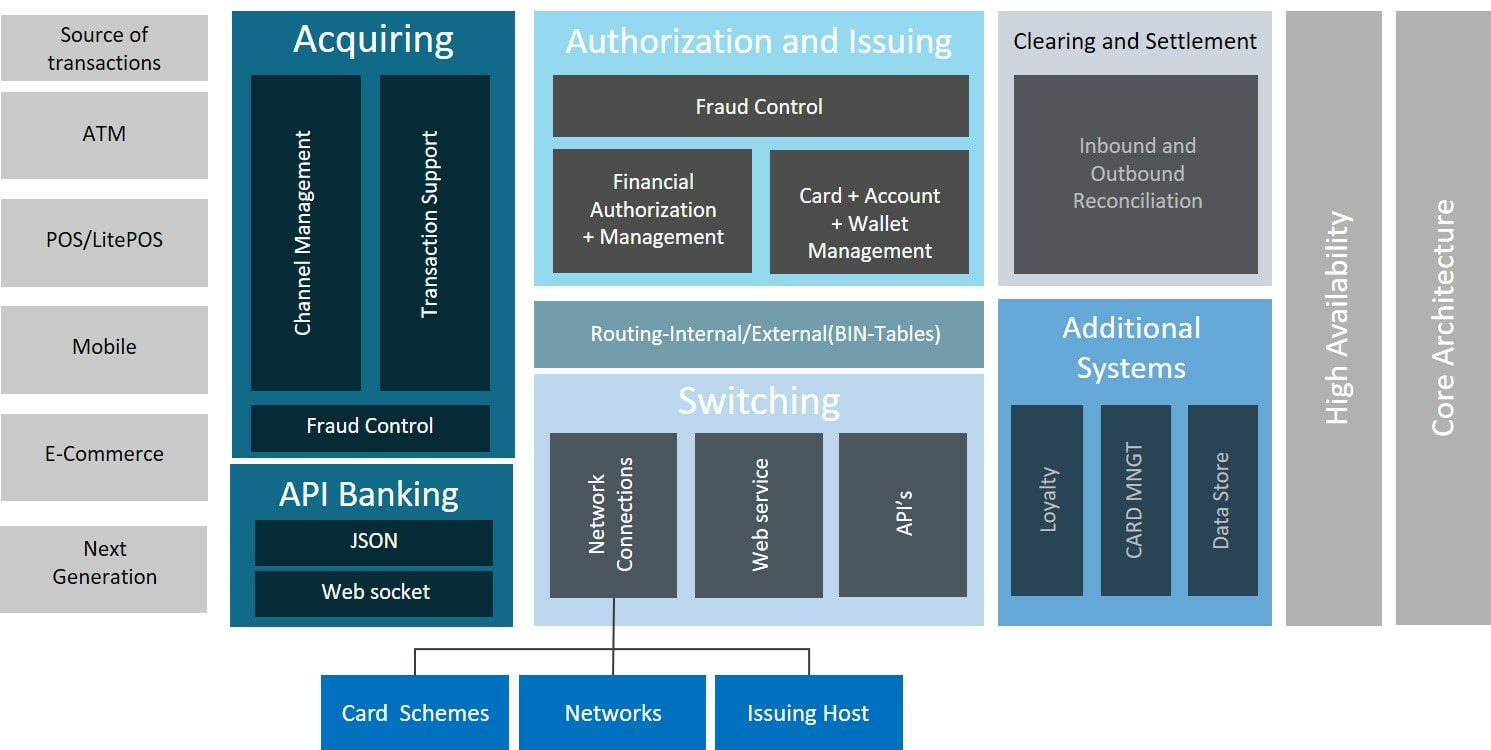

Please sign up ahead of time for our presentation: Today’s Payments Market: Creating Opportunities from Challenges - November 17th at 12:15 PM PST. Payment processing today is evolving at a rapid rate. It’s not just the technology, allowing more transactions to be generated through new channels. New players are constantly emerging in the marketplace and using new technology to provide exciting new financial services to consumers, who are less loyal to traditional financial institutions and are more demanding than ever. Organizations with legacy solutions face increasing costs to maintain/extend while requiring months/years of hard coding for development of new products for market. To keep pace in a dynamic industry and outperform competitors, you need modern, flexible solutions that help streamline new offerings. This presentation introduces TANGO from Lusis Payments, a state-of-the-art technology with unparalleled configurability provided by its microservices-based architecture. TANGO facilitates the rapid introduction of new business and technical services, enables seamless integration with in-house and third-party applications, and facilitates support for current and future payment components. These features combine not only to address today’s challenges, but also to create a modern payments platform to benefit from further technology and business advancements that will inevitably occur in the future. TANGO’s architecture deeply integrates with some of the modern and core fundamentals of HPE NonStop such as use of OSS and TMF-protected SQL/MX database, and full exploitation of HPE NonStop “process pair” feature through its hypervisor process. The dispatcher functionality works together with HPE NonStop TS/MP to provide scalability and availability, and supports the active/active configuration. This further establishes HPE NonStop as one of the most ideal platforms to run your TANGO payments solution. Be sure to check out our presentation on November 17th at 12:15 PM PST at the NonStop Technical Boot Camp or visit: lusispayments.com/onewebcast to schedule a one-on-one Zoom call.  Lusis Payments is pleased to welcome our newest industry partner, Bluefin Payment Systems. Bluefin is a payment security company that provides the leading security platform supporting payment gateways, processors and independent software vendors (ISV’s) in 29 countries. Bluefin’s secure payment platform is key to a holistic approach to data security. Designed to complement EMV and tokenization, Bluefin’s PCI-validated Point to Point Encryption (P2PE) solutions provide a solid security defense against current and future data breaches. Bluefin supports point of sale solutions for retail, mobile, call center and kiosk/unattended environments, and secure Ecommerce technologies. Lusis is proud to offer our clients the option of Point to Point Encryption solutions from Bluefin that work seamlessly with our TANGO payments solutions. We are committed to providing our clients with the most innovative and secure solutions in the payments industry. We do so with win-win partnerships that further emphasize our to commitment to excellence within the industry. If your organization would like to become a Lusis Payments Industry Partner, please contact Brian Miller at [email protected].  It is in this year, 2018, that the PSD2 (Revised Payment Service Directive) will be implemented. Instructions from the European Union (EU), banks’ monopolies on their customers’ account information and payment services will no longer be permitted. PSD2 will enable bank clients to use third-party vendors to provide financial services on their behalf. In the near future, clients will have the option of using any provider to pay their bills via person-to-person (P2P) transfers, while still having their money assets secured in their current bank account. Banks will be obliged to ensure that these third-party providers are given access to “their” customers’ accounts through open Application Programming Interfaces (APIs). This will enable third-parties to build financial services on top of banks’ data and infrastructure. All of this will significantly change a bank’s competition model. It will not be about changing account location; rather, it will be about the services that customers use. No longer will banks be competing against their peers. Instead, they will be competing against one another. PSD2 will change customer expectations; payments’ value chains; and determine what business models are profitable. The Payment Initiation Service Provider (PISP) and the Account Information Service Provider (AISP), are two entries into the EU’s changing financial system. Because of PSD2, they are service providers which will have access to the account information of bank customers. The fact is that such services could look at a user’s spending behavior and provide analysis, or even aggregate a user’s account information from several banks, looking at that as well. A PISP provider initiates a payment on behalf of the user, with P2P transfer and bill payment as component parts sure to be seen when PSD2 is enacted. A More International Perspective It is well understood that the EU evidences great ambition and in so doing it issues laws or directives to realize its goals. The EU ‘s involvement in the deregulation of telcos has produced spectacular outcomes. Huge operators have transformed old national monopolies in national amphi-polies, tri-polies or tetra-polies. In the meantime, the telco industry itself has been badly damaged and is now dying. Today, Europeans buy phones via the United States (US) or Korea and network switches in China or the US. As to bank services, and with no directives, it is very possible that Citibank, Bank of America Corporation (BAC), and Chase Bank will do better more quickly if they may take advantage of the frantic activity Europeans are going to create in their homelands. No matter what, it is clear that the mandate is for creation of a more competitive bank environment, thereby creating a global marketplace for European bank services. Lusis payment hub SOA architecture provides agility and scalability for an evolving marketplace

SAN FRANCISCO & PARIS--(BUSINESS WIRE)--Lusis Payments, a global innovator of mission-critical payments software, announced today that CIBC, a leading Canadian-based global financial institution, has migrated its POS, ATM, and Payments Hub to the Lusis TANGO platform. CIBC has been modernizing its payments infrastructure to improve their ability to meet the demands of today’s evolving payments ecosystem. TANGO is an online transaction processing engine for mission-critical 24x7 solutions including payments, retail, loyalty, finance, utilities, and transport. TANGO delivers performance, availability, and scalability, with a rich set of functionalities, all from a single application, a single code set and a single architecture. This flexibility makes TANGO ideal for the next generation of payment systems. CIBC selected Lusis Payments’ TANGO product for use across a range of banking channels. TANGO allowed the bank to move to an open platform built on a high-performing micro-service architecture providing agile banking needs. CIBC has also implemented a number of new functionalities and capabilities to its payments systems as a result of the migration. “TANGO is the payments HUB facing todays challenge,” said Philippe Preval, President and CEO of Lusis Payments. “TANGO is addressing business needs both now and in the foreseeable future. Our team worked closely with CIBC to provide the flexibility it needs in today’s evolving payments landscape.” About Lusis Payments Lusis Payments is an innovative global software and services provider to the payments industry. The company’s proven, cutting edge technology operates in numerous hardware and operating environments. The TANGO platform, combined with the know-how to mitigate risk and deliver high levels of assured customer service, constitutes a unique proposition for organizations faced with the challenge of adapting to traditional and future needs in the payments ecosystem. Contacts Lusis Payments Brian D. Miller, 415-829-4577 General Manager [email protected]  A FEATURED ARTICLE ON ATM MARKETPLACE by Philippe Préval, CEO, Lusis Payments Banks at a Crossroads Although cash delivery activity seems to be decreasing due to contactless payments and wallets, in North America, the Automated Teller Machine (ATM) channel is still maintaining its central role as a core banking touchpoint with the consumer. It has become an integral part of the banking omni-channel experience, not only playing a key role in the broad context of modern banking but also being a major enabler of mission-critical “access to funds” functionality within financial inclusion initiatives. The channel is taking an even more important role as branch network optimization leads to a reduction in the number of branches while consumers still express a preference for banks with a physical presence. On the other side of the ocean, some European major companies seem to see the ATM business as a dying activity that can be easily outsourced to service providers that provide a low cost/poor user experience. So, who is on the right path between these two radically different approaches? New features that are coming in front-line for ATMs may be giving evidence of a really interesting future for those teller machines putting the truth on the United States’ (US) side. Banks’ Initiatives There are interesting initiatives related to activation of classical cash functions using contactless devices, including Smartphones. New functions for providing cash to one individual using his or her Smartphone are already very popular in the US and totally marginal in Europe. There are two ways of delivering cash to someone: 1) Using a Smartphone Radio-frequency identification (RFID) capacity and wallet to allow a customer to retrieve cash from an ATM, there is a wallet Device Primary Account Number (DPAN) used in place of a card. DPAN is also known as the Digital Primary Account Number. Once the wallet is authenticated, even the on-us transactions are available for the user. On-us transactions are those for which all transactions for an ATM or a Point of Sale (POS) machine originate from the same bank. The only condition is to re-authenticate the wallet every time the user chooses a function. 2) Cash can be sent to a third-party holder using wallets. An ATM is then used to dispense cash to the destination user. Some ATM Vendors´ Initiatives Following is a brief discussion of two interesting initiatives proposed by the two market leaders. NCR Corporation’s ITM The NCR ITM (Interactive Teller Machine) is an Assisted Service hardware solution. It has the same footprint as an NCR Self Service ATM system but has integrated two-way video conferencing with additional software and hardware to support live interaction with a remote teller. The NCR ITM includes audio capabilities beyond a typical ATM, as well as incorporates peripherals to support the member experience like a phone handset for privacy or a signature pad to require customers to sign for certain activities. The ITM can be supported as a stand-alone video teller solution. Diebold ILT The In-Lobby Teller (ILT) is offering Branch services without a real Branch and tellers or inside a Branch but with fewer teller agents. It is an innovative solution that redefines the Branch experience for both the bank and its customers. The ILT bridges the gap between the teller and the ATM by combining the convenience and accuracy of a machine with the natural and personal interaction of a human. All operations that a customer can do in a Branch are available, including deposit, withdrawal and all home banking functions. A dramatic productivity increase is anticipated with ILT, with one teller being able to pilot the dialog of several ILT in various locations. All these new channels use modern JavaScript Object Notation (JSON) web services to carry the transactions’ information to the payment system that manages the ITM, ILT. |

lUSIS nEWSThe latest company and industry news from Lusis Payments. Archives

June 2024

Categories

All

|

RSS Feed

RSS Feed