LITEPOSIn the last decade almost every industry has taken advantage of developments made in technology. Modern architectures, languages, tools and databases have enabled much more responsive, easier to maintain and lower cost solutions to rise and dominate the landscape. One industry remains stubbornly at odds with this: retail payments, which continues to use legacy systems and suppliers. Inefficiencies experienced by financial institutions today are a direct result of these inflexible, costly and unresponsive legacy systems. The payments system of the future should provide open and more productive systems allowing innovation and product development to provide new business in rapid time frames while remaining cost effective.

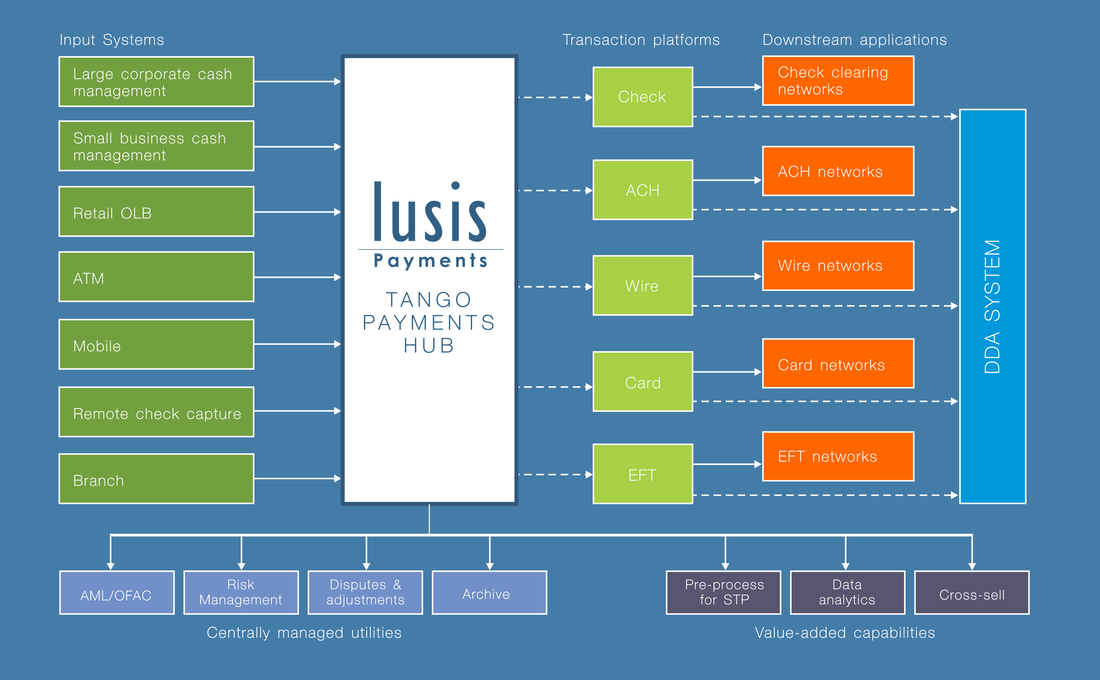

TANGO is a state of the art technology, offering a modern, integrated infrastructure that is highly performant and highly efficient, while its genuine service-oriented architecture significantly reduces development time and cost. The core principles of TANGO’s architecture provide the maximum flexibility regarding choice of platform, database, and operating environment, making the payment system of the future available today. |

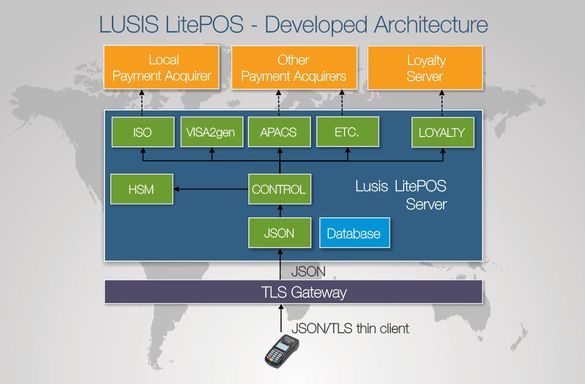

THE LUSIS LITEPOS SOLUTIONLusis LitePOS effectively splits a POS device into two component parts: a local device and a central terminal management server. The solution allows organizations to offer a secure, more cost-effective, flexible and scalable POS environment for retailers. Independent of terminal suppliers, Lusis LitePOS combines traditional payments services with value-added services — such as gift cards, online loyalty, promotional offers and installment payments — to create a complete, tailor-made offering for retailers. By challenging the traditional POS terminal environment, the Lusis LitePOS terminal is used only for price, card reading and PIN entry.

This enables the deployment of inexpensive, limited-functionality devices. The payments server then provides the added functionality required for these local devices, including terminal and merchant parameters, the connection to the acquirers, data segregation, and compliance. The POS terminal communicates with the payment server using a unique application dialogue based on JSON, which has already been implemented by top providers. The payment server provides the following:

Reduce Costs Because of the lower costs associated with Lusis LitePOS, financial institutions can extend their POS terminal offerings to a wider base of smaller merchants, even allowing those not currently using online or EMV-compliant POS devices to roll out these PIN-pad devices by providing them with access to secure payments services. Standardize Updates By deploying all of the logic and functionality within the Lusis LitePOS payments server, financial institutions can centralize all logic, so updates and changes can be implemented more quickly and standardized across a selected terminal estate.

|

Features at a Glance

HPE Cloud28+ Partner

|

|

CRÉDIT AGRICOLE INTEGRATES THE LUSIS LITEPOS SOLUTION INTO ITS GLOBAL PAYMENT PROJECT

Crédit Agricole integrates the Lusis LitePOS solution into its global payment project in order to address payment requirements in any format from across Europe. Crédit Agricole Cards and Payments is a major European player in the payment space and its POS estate comprises approximately 300,000 terminals. Deploying Lusis LitePOS has delivered increased flexibility, scalability and reactivity. After a successful product trial over 12 months, Lusis LitePOS solution for Crédit Agricole, called TMS (Terminal Multi Services), has been rolled out ...more |

PROVEN ARCHITECTURE

lusis payments solutions

MESSAGE SWITCHINGLusis offers a highly effective and performant message translation and switching solution. Our products have been implemented for clients with extreme volume message switch processing needs.

TRANSACTION PROCESSINGCovering the acquiring of transactions from any source or network through to the settlement and inter-scheme management of funds, TANGO comprehensively supports all manner of payment processing. TANGO is suitable for acquirers, issuers and PSPs. Our solution is highly configurable to enable direct alignment to customers' business and technical needs.

FRAUDLusis offers an advanced technological solution to compliment online transaction processing that complies with industry standards.

|

loyalty managementFrom simple to complex deployments, Lusis provides highly flexible loyalty solutions that enable clients to gain significant market advantages over their competitors.

lITEPOSOur LitePoS Terminal in the cloud is changing the payments processing world. LitePoS dramatically lowers costs and enhances revenue opportunities while allowing customers to break new ground with new and existing clients.

MULTI-ASSET TRADING PLATFORMLusis provides an ultra-high performant trading platform for Forex, CFD, equities, and options. It integrates cutting edge technologies such as cryptocurrencies and Blockchain based settlement.

|

The TANGO Payments Engine supports acquiring, routing, switching, authenticating, and authorizing transactions across multiple channels including ATM, Point of Sale, Internet, and Mobile Banking, in a multi-institution environment that may span different geographies.

|

An Overview of TANGO

TANGO is today’s modern payments system, using state-of-the-art technology to address business needs both now and in the foreseeable future ...more |

An Overview of LitePOS

LitePOS effectively splits a POS device into two component parts: a local device and a central terminal management server ...more |

TANGO 10,000 TPS

The proof of concept was performed to showcase the TANGO architecture performance in a cloud environment ...more |

|

Stress Test

Bankserv Africa, performed a stress test of TANGO on their own Production and Test systems. The stress test was conducted on the busiest transactional days due to SASSA payments. ...more |

Lusis Disrupts Capital Market with Artificial Intelligence

The applications for artificial intelligence and data science are infinite; in many ways, we've only begun to tap in to their potential. ...more |

PSD2 -International Perspective

by Philippe Préval The Revised Payment Service Directive will be implemented in 2018. ...more |

|

Option to Legacy PMT Systems

Cast off the legacy system that is holding you back. Enable your business to Defend,Compete, Attack. Do Something with TANGO ...more |

ASC X9 TR-31 & TR 34

There are two evolutions that have emerged from the standards that will introduce a massive change in ATM and POS remote key management. ...more |

|

Investment Solution Platform

Drive and share ideas on financial products with your Asset managers to improve the performance of clients’ portfolios. Full HTML5 platform ...more |

BankservAfrica Case Study

BankservAfrica chooses TANGO after a comprehensive business and technology evaluation ...more |

Updating Your Payments System

Updating or refreshing your payments system should be used as an opportunity to explore, innovate and transform your payment operations ...more |