HPE & LUSIS PARTNERSHIP OFFERS

|

TANGO for Retail Payments is a proven payments solution that provides a modern, service oriented architecture for acquiring, routing, switching, authenticating, and authorizing transactions across multiple channels e.g. ATM, POS, and Internet and mobile banking. TANGO provides unlimited scalability and supports multi-institution deployments across different geographies.

Modern consumers are continually pushing for better, faster, and more accessible Services. Lusis Payments is dedicated to helping our clients satisfy the evolving consumers' needs by providing the best technology solutions and support in the payments industry.

TANGO's cloud-native, microservices architecture provides unrestricted scale and has been benchmarked at 10,000 tps with constant response times.

For organizations looking for ways to modernize their payment system experience, HPE is introducing HPE GreenLake for Payments in partnership with Lusis. With this solution, customers benefit from complete payment solutions, pay per transaction, a platform that supports contactless payments, and easy to maintain compliance – all with the cloud experience. This builds on the momentum and market footprint for the HPE GreenLake cloud platform which today serves hundreds of banks and financial institutions around the world.

“Partnering with HPE has been a critical part of our growth and success as we expand into international markets,” said Philippe Préval, President and CEO, Lusis. “And today, four of the ten biggest banks in the world are using Lusis payment systems. As more of our clients seek out cloud features and services on demand, HPE GreenLake for Payments allows us to offer them our world-class payment solution, delivered as a service, wherever their apps and data reside.”

Modern consumers are continually pushing for better, faster, and more accessible Services. Lusis Payments is dedicated to helping our clients satisfy the evolving consumers' needs by providing the best technology solutions and support in the payments industry.

TANGO's cloud-native, microservices architecture provides unrestricted scale and has been benchmarked at 10,000 tps with constant response times.

For organizations looking for ways to modernize their payment system experience, HPE is introducing HPE GreenLake for Payments in partnership with Lusis. With this solution, customers benefit from complete payment solutions, pay per transaction, a platform that supports contactless payments, and easy to maintain compliance – all with the cloud experience. This builds on the momentum and market footprint for the HPE GreenLake cloud platform which today serves hundreds of banks and financial institutions around the world.

“Partnering with HPE has been a critical part of our growth and success as we expand into international markets,” said Philippe Préval, President and CEO, Lusis. “And today, four of the ten biggest banks in the world are using Lusis payment systems. As more of our clients seek out cloud features and services on demand, HPE GreenLake for Payments allows us to offer them our world-class payment solution, delivered as a service, wherever their apps and data reside.”

HPE GREENLAKEHPE GreenLake for Payments is a secure, worry-free, consumption-based cloud infrastructure service with full remote management. It simplifies and automates tasks resulting in an improved business responsiveness to new opportunities.

Like the alternate Cloud Infrastructure providers, GreenLake provides a choice of Windows or Linux platforms. However, GreenLake also offers HPE's proven Virtualised NonStop software. Importantly, this provides GreenLake customers with a unique competitive advantage of the highest service availability for Retail payments processing. |

HPE & Lusis Partnership

2021 HPE DISCOVER interview with Philippe Préval - President /CEO of Lusis |

|

Over the previous decades, ACI Worldwide's BASE24 Classic solution on HPE NonStop was considered the gold standard for large scale Retail Payments. Applications may come and go, but the NonStop fundamentals have remained timeless.

“HPE is delighted to partner with Lusis Payments and TANGO as the premier Retail Payments solution for future generations.” |

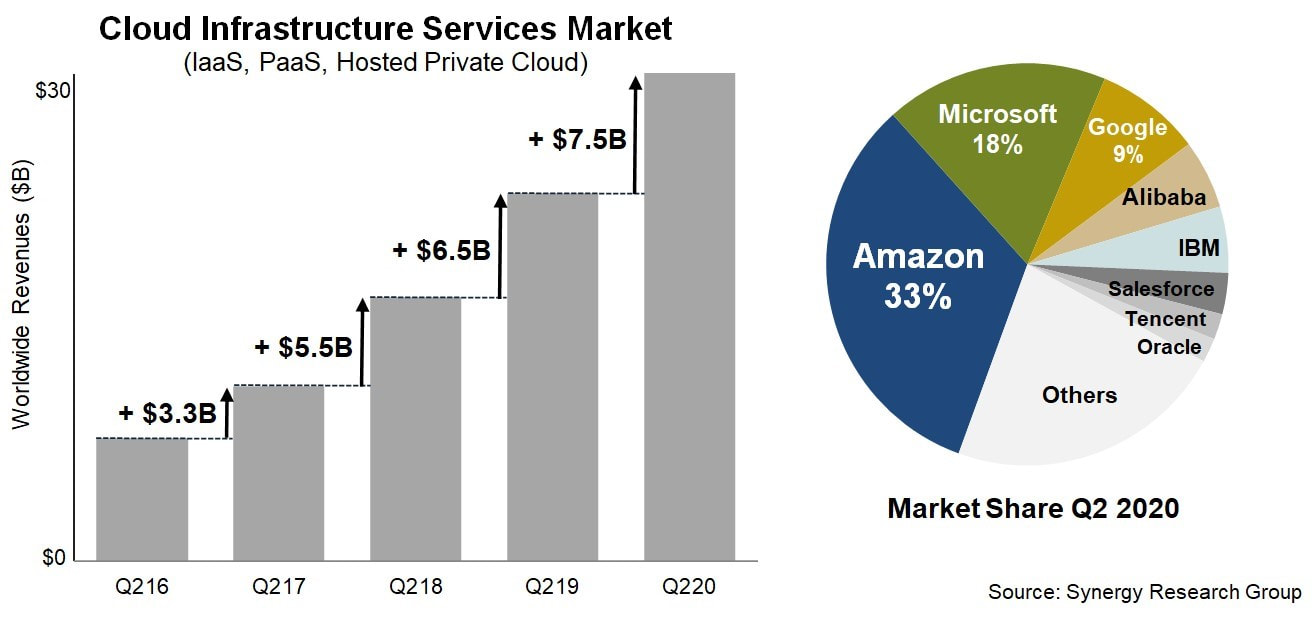

Cloud Infrastructure Market: Accelerating Growth

|

unmatched reliability

Lusis participated in a customer proof-of-concept that demonstrated its TANGO platform capable of processing 2,500 transactions per second (TPS) for 48 hours straight without any failures.

The POC client currently operates more than 20 million terminals, deployed in over 125 countries, which include some of the world's largest financial institutions.

The POC client currently operates more than 20 million terminals, deployed in over 125 countries, which include some of the world's largest financial institutions.

Highlights of TANGO Proof of Concept

- Proved fault-tolerant and responsive

- Achieved maximum volumes and throughput of 50 million transactions per day

- Processed 2,500 TPS for 48 hours straight

The proof-of-concept tests were run by HPE at its Palo Alto, California, facilities on HP hardware. HPE worked with the client to faithfully reproduce their environment for a true simulation.

“TANGO is a lot more configurable and is parameter-driven. From a flexibility and maintainability perspective it's also a lot easier, and that is a big benefit for us.” |

protect yourself against fraudTighter payments regulations; evolving platforms, and new initiatives, such as PSD2, GDPR and 3DS2.0, etc., require advanced fraud technology. That is why implementing a solution like Tango AIF™ to enrich detection to combat fraud is critical.

The NonStop AdvantageTango AIF™ has proven to be more accurate and robust for any real-world fraud scenario where complete data is not always available or accurate. |

A REFRESHING PARTNERSHIP MINDSET

|

The message from the legacy suppliers is the same in every industry when a change in paradigm occurs: it can't be done; it will never work; it's too much like magic. The fact is that it can be done; it has been done and is being done.

Financial Institutions are upgrading their Retail payment systems and positioning for the future. In the process they are freeing themselves from the business constraints of time, cost, and functionality deficiencies. Consequently, they are empowered to provide significantly better customer service and value. By embracing TANGO, our clients have successfully migrated their payments services onto a modern, agile platform. Lusis' delivery expertise and experience ensures that projects are delivered quickly, and safely, and are backed by our highly responsive support team. |