Fighting Fraud with the Latest Technologies

|

LUSIS TANGO AI FRAUD

The need for a cutting-edge, real-time fraud solution has never been so critical as it is now. The world has seen an unprecedented switch from CP (cardholder present), to CNP (cardholder not present) online transactions, which has massively changed the patterns of fraudulent activity for OLTP (online transaction processing). The rise in on-line retailing in 2020 is over 200% and climbing as consumers and businesses feel the pinch from the lack of ability to transact and shop the way we have always done.

It is known that sellers using online services will lose $130 billion to payment fraud between 2018 and 2023.

Organizations that process online payments need the agility to rapidly counteract this industry swing. Lusis Payments is in the perfect position to help you achieve this.

|

The Changing Retail Landscape Across the retail sector, every acquiring and issuing payments environment must have the dexterity to manage all of these activities while meeting strict compliance guidelines, managing data and IT cybersecurity, and more. Ultra-intelligent and safe financial fraud and payments systems are a prerequisite for any modern economy. They enable everyday transactions, thus providing the foundation for commerce and trade. Over time, all payments ecosystems globally have developed inefficiencies and lost some of their ability to innovate and adapt to the changing needs of end-users. The platforms tend to be old, outdated systems that have inefficiently evolved together over time. And fraudsters love this — it's “easy pickings” for them. In reality this is serious cybercrime and fraudsters whose technology is as advanced, if not more advanced than ever before. Phishing, digital identity cloning, sim take over are all huge areas for large losses and exposed old technology |

|

The Solution: TANGO AIF™ by Lusis By deploying Lusis AI Fraud powered by TANGO (TANGO AIF™) you will get a brand new solution incorporating the latest advances in AI/ML for fraud monitoring, detection and action — technology that provides the latest methods for processing secure transactions, irrespective of source, nature or market segment. Over the past 5 years Lusis have worked closely with the universities in Paris developing, honing and advancing the fraud product. This work is independent, and we have the cleverest minds and a chair on the board testing, reviewing and adding advances that keeps us 1-2 steps ahead of any similar platform on the market. TANGO AIF is the most advanced true AI/ML platform you can deploy, fast and secure. |

|

Tighter payments regulations; evolving platforms, and new initiatives, such as PSD2, GDPR, SCA and 3DS2.0, etc., require advanced fraud technology. That is why implementing a solution like Tango AIF to enrich detection to combat fraud is critical. As service providers, retail banking organizations need to maintain control over these issues while upholding compliance and protecting revenues.

The strategic importance of correct and learned instant fraud decisioning cannot be overstated. Tango AIF helps organizations realize cost efficiencies and enhance customer service, providing state-of-the-art real-time services to obtain and retain your invaluable customer base.

Somewhere in this mass of new tech and ever-increasing alternative payment methods (APMs), the need to modernize your fraud platform becomes a must. Never has the industry been under as much public scrutiny as it is right now, and the expectations are high.

Many customers already benefit from using the Lusis Tango platform across multiple disciplines to ensure reliability and ease of doing payments processing. The migration from old, legacy solutions to new cooperative environments is happening right now with top-level Fis.

Fraud detection using deep learning and AI helps to complete complex data analysis within milliseconds and detects both random and targeted patterns in the most efficient way, a task that can be difficult for a fraud analyst to detect. AI eliminates time-consuming tasks and enables fraud analysts to focus on mission-critical cases.

The strategic importance of correct and learned instant fraud decisioning cannot be overstated. Tango AIF helps organizations realize cost efficiencies and enhance customer service, providing state-of-the-art real-time services to obtain and retain your invaluable customer base.

Somewhere in this mass of new tech and ever-increasing alternative payment methods (APMs), the need to modernize your fraud platform becomes a must. Never has the industry been under as much public scrutiny as it is right now, and the expectations are high.

Many customers already benefit from using the Lusis Tango platform across multiple disciplines to ensure reliability and ease of doing payments processing. The migration from old, legacy solutions to new cooperative environments is happening right now with top-level Fis.

Fraud detection using deep learning and AI helps to complete complex data analysis within milliseconds and detects both random and targeted patterns in the most efficient way, a task that can be difficult for a fraud analyst to detect. AI eliminates time-consuming tasks and enables fraud analysts to focus on mission-critical cases.

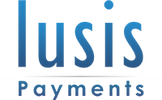

wHY MACHINE LEARNING?

Complex mathematical algorithms are the power behind machine learning. In reality, there is no single best algorithm or rule set that universally performs better in all types of fraud scenarios, across all sectors. Assigning and choosing the best algorithm depends on many factors, such as size, resources, type, scale etc. Using random forests (multiple decision trees) and adding deep learning is the best way to cover all scenarios with the constant changing face of fraud both internal and external.

Tango AIF™ is incredibly fast to train, learn and score, which is why Lusis built this model using RF as the core technology. It's the most advanced method to fight fraud, and, as a technology fraud layer, it wins the most awards among data science gurus and machine learning communities. |

AI IS THE FUTURE OF ONLINE FRAUD DETECTION

According to the Association of Certified Fraud Examiners (ACFE), by 2021, organizations are expected to triple the amount they spend on AI and machine learning to thwart online fraud. The ACFE study also found that only 13% of organizations currently use AI and machine learning to detect and deter fraud today. The report predicts another 25% plan to adopt these technologies in the next year or two — an increase of nearly 200%. The ACFE study found that AI and machine learning technology most likely will be adopted in the next two years to fight fraud, followed by predictive analytics and modelling.

TANGO AIF is easily configured to add value to existing channel-specific services offered to customers, as well as to respond rapidly to any new business opportunity that presents itself.

TANGO AIF is easily configured to add value to existing channel-specific services offered to customers, as well as to respond rapidly to any new business opportunity that presents itself.

WHY LUSIS TANGO AIF?

|