|

TANGO is today's modern payments platform, using state-of-the-art technology to address business needs both now and in the foreseeable future. The core principles of TANGO's architecture provide the maximum flexibility regarding choice of platform, database and operating environment to meet hardware and software preferences.

TANGO is built on a highly performing micro-services architecture providing agile delivery for business. The collection of autonomous services work together to provide a global service and can be developed separately and deployed and run independently. Our CBSD approach leads to reduced development and maintenance costs which provides faster time-to-market and an ongoing, cost-effective payments solution. |

tango

|

With it's versatile common architecture, TANGO removes issues regarding integration associated with disparate legacy systems and can be deployed on one hardware platform, or multiple hardware platforms, from the same or different hardware vendors all running the same TANGO infrastructure and code base.

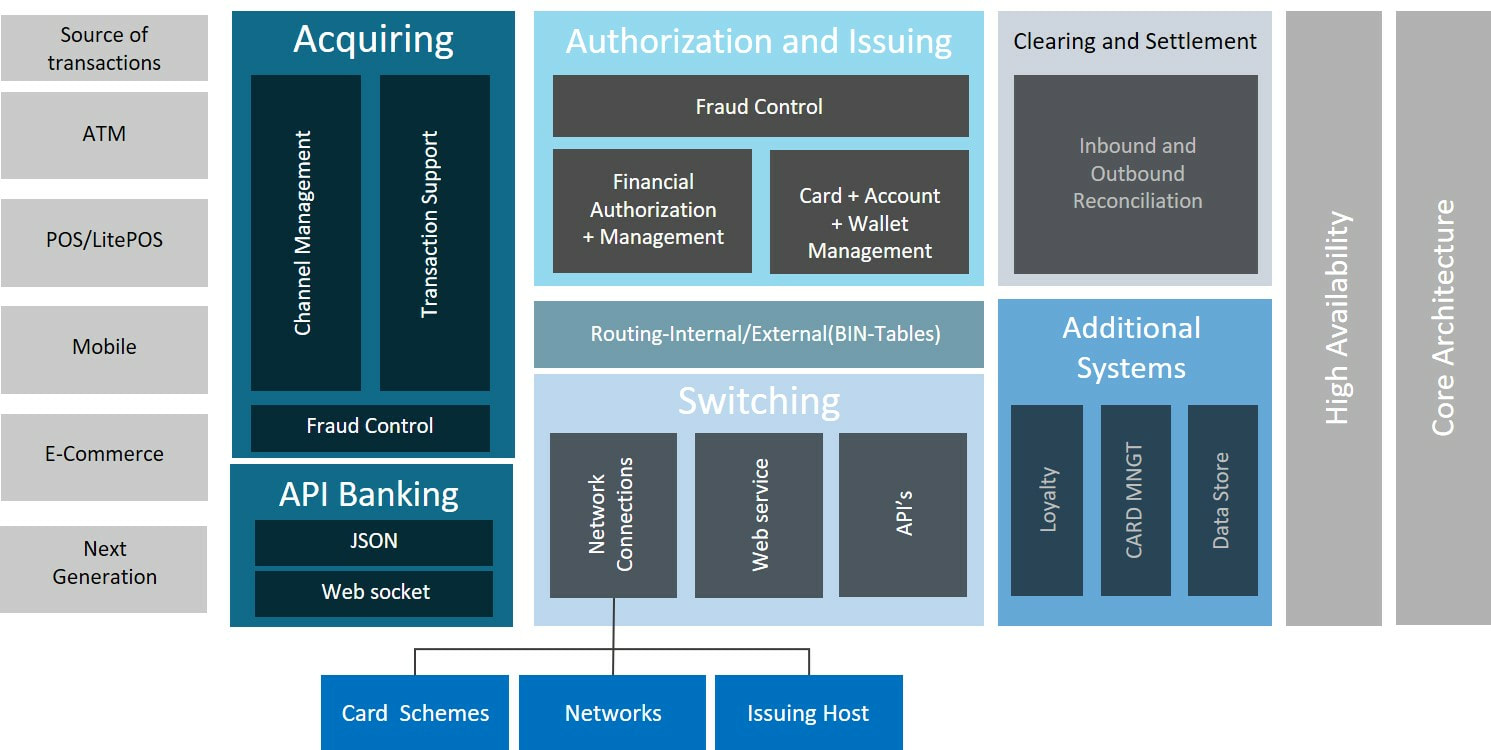

TANGO provides a modern, open SOA for acquiring, routing, switching, authenticating and authorizing transactions across multiple channels — including ATM, point of sale, Internet and mobile banking — in a multi-institution environment across different geographies.

TANGO's unique design removes complexities and reduces migration time frames. Off-the-shelf functionality and rapid development capability means that standard card types, international card schemes and devices, national switches, and hosts can be deployed easily, within the standard product.

TANGO provides a modern, open SOA for acquiring, routing, switching, authenticating and authorizing transactions across multiple channels — including ATM, point of sale, Internet and mobile banking — in a multi-institution environment across different geographies.

TANGO's unique design removes complexities and reduces migration time frames. Off-the-shelf functionality and rapid development capability means that standard card types, international card schemes and devices, national switches, and hosts can be deployed easily, within the standard product.

WATCH OUR 13 MIN VIDEO ON TANGO BUSINESS FRAMEWORK & DIFFERENTIATORS

|

What is a Microservice Architecture?

A microservice application is a collection of autonomous services, each of them doing one thing well, and when combined, work together to provide a global service. Instead of a single complex system (monolithic architecture), the aim is to build and manage a set of relatively simple services that might interact in complex ways. These services collaborate with each other through a messaging protocol.

Microservices promise a better way to sustainably deliver business impact. Rather than a single monolithic unit, applications like TANGO, built using microservices are made up of loosely coupled, autonomous services. Building services that do one thing well avoids the inertia and entropy of large applications. |

This article is an introduction to TANGO version 8, a major upgrade that provides full microservice integration and complete Cloud capacities.

|

Next Generation Retail Payment technology

TANGO is a Mission Critical System that does NOT Fail

For this reason, many large banks and financial institutions as well as other mission critical businesses have chosen the TANGO solution for many years. These organizations have demanded a modern, open architecture with superior availability, scalability and data integrity as they look to the future.

TANGO is a transaction processing system for acquiring, routing, switching, authenticating, and authorizing transactions across multiple channels including ATM, POS, e-Commerce, and Mobile. The TANGO Payments Server is based on a generic architecture that has no restrictions on transaction types: both standard and non-standard transactions can be easily defined in the system, as can new transaction types and message flows.

TANGO operates as a truly integrated processing engine allowing full support for traditional payments processes such as high availability and fraud detection. These are integrated into the architecture as part of standard product, reducing dependence on 3rd party software and removing any associated compatibility issues. In addition, financial institutions can use TANGO to expand beyond the traditional types of transactions. For example, loyalty programs can co-exist within the same architecture and code base.

On top of all this TANGO supports a number of APIs that can be plugged into other internal bank systems to ease integration. For example, the Java plug-in can reside on a Java system and interact with the Java adapters in that system, whilst communicating to the TANGO server in internal TANGO format. This removes the need to specify a particular protocol just to talk to the Java system.

TANGO's modern, flexible, service-oriented architecture supports a number of relational databases operating across multiple platforms. Based around a central data bus containing all transaction and configuration data, authorization is based on configurable parameterized data held in tables rather than scripts which is more performant, controllable and flexible.

For this reason, many large banks and financial institutions as well as other mission critical businesses have chosen the TANGO solution for many years. These organizations have demanded a modern, open architecture with superior availability, scalability and data integrity as they look to the future.

TANGO is a transaction processing system for acquiring, routing, switching, authenticating, and authorizing transactions across multiple channels including ATM, POS, e-Commerce, and Mobile. The TANGO Payments Server is based on a generic architecture that has no restrictions on transaction types: both standard and non-standard transactions can be easily defined in the system, as can new transaction types and message flows.

TANGO operates as a truly integrated processing engine allowing full support for traditional payments processes such as high availability and fraud detection. These are integrated into the architecture as part of standard product, reducing dependence on 3rd party software and removing any associated compatibility issues. In addition, financial institutions can use TANGO to expand beyond the traditional types of transactions. For example, loyalty programs can co-exist within the same architecture and code base.

On top of all this TANGO supports a number of APIs that can be plugged into other internal bank systems to ease integration. For example, the Java plug-in can reside on a Java system and interact with the Java adapters in that system, whilst communicating to the TANGO server in internal TANGO format. This removes the need to specify a particular protocol just to talk to the Java system.

TANGO's modern, flexible, service-oriented architecture supports a number of relational databases operating across multiple platforms. Based around a central data bus containing all transaction and configuration data, authorization is based on configurable parameterized data held in tables rather than scripts which is more performant, controllable and flexible.

TANGO BUSINESS FRAMEWORK |

FEATURES AT A GLANCE • Microservice transactional platform • Uses industry-standard C++ and XML • Supports industry-standard messaging specifications, such as XML, ISO 8583 and ISO 20022 • Provides a state-of-the-art, modular, object-oriented system • Operates independently of operating systems and databases • Offers a multi-channel, multi-institution, multi-language and multicurrency solution • Provides high performance and high availability • Allows a flexible implementation • Offers complete transaction security support (EMV, 3DES) • Adds value to retail payments to increase flexibility |

lusis payments solutions

MESSAGE SWITCHINGLusis offers a highly effective and performant message translation and switching solution. Our products have been implemented for clients with extreme volume message switch processing needs.

TRANSACTION PROCESSINGCovering the acquiring of transactions from any source or network through to the settlement and inter-scheme management of funds, TANGO comprehensively supports all manner of payment processing. TANGO is suitable for acquirers, issuers and PSPs. Our solution is highly configurable to enable direct alignment to customers' business and technical needs.

FRAUDLusis offers an advanced technological solution to compliment online transaction processing that complies with industry standards.

|

loyalty managementFrom simple to complex deployments, Lusis provides highly flexible loyalty solutions that enable clients to gain significant market advantages over their competitors.

lITEPOSOur LitePoS Terminal in the cloud is changing the payments processing world. LitePoS dramatically lowers costs and enhances revenue opportunities while allowing customers to break new ground with new and existing clients.

MULTI-ASSET TRADING PLATFORMLusis provides an ultra-high performant trading platform for Forex, CFD, equities, and options. It integrates cutting edge technologies such as cryptocurrencies and Blockchain based settlement.

|

The TANGO Payments Engine supports acquiring, routing, switching, authenticating, and authorizing transactions across multiple channels including ATM, Point of Sale, Internet, and Mobile Banking, in a multi-institution environment that may span different geographies.

|

TANGO AI FRAUD

Fighting Fraud with the latest technologies by Lusis. Fraud monitoring, detection and action for secure transaction processing. ...more |

HPE NonStop for Lusis TANGO

Modern TANGO platform leverages 100% fault-tolerance of HPE NonStop to provide a complete, future-ready payments solution ...more |

|

An Overview of TANGO

TANGO is today’s modern payments system, using state-of-the-art technology to address business needs both now and in the foreseeable future ...more |

An Overview of LitePOS

LitePOS effectively splits a POS device into two component parts: a local device and a central terminal management server ...more |

TANGO 10,000 TPS

The proof of concept was performed to showcase the TANGO architecture performance in a cloud environment ...more |

|

Stress Test

Bankserv Africa, performed a stress test of TANGO on their own Production and Test systems. The stress test was conducted on the busiest transactional days due to SASSA payments. ...more |

Lusis Disrupts Capital Market with Artificial Intelligence

The applications for artificial intelligence and data science are infinite; in many ways, we've only begun to tap in to their potential. ...more |

Is the United States Ready for Cash Recycling?

The idea of cash recycling comes from the machines' capability to accept and sort cash deposits and then dispense that same cash for withdrawals. ...more |

|

Option to Legacy PMT Systems

Cast off the legacy system that is holding you back. Enable your business to Defend,Compete, Attack. Do Something with TANGO ...more |

ASC X9 TR-31 & TR 34

There are two evolutions that have emerged from the standards that will introduce a massive change in ATM and POS remote key management. ...more |

|

Investment Solution Platform

Drive and share ideas on financial products with your Asset managers to improve the performance of clients’ portfolios. Full HTML5 platform ...more |

BankservAfrica Case Study

BankservAfrica chooses TANGO after a comprehensive business and technology evaluation ...more |

Updating Your Payments System

Updating or refreshing your payments system should be used as an opportunity to explore, innovate and transform your payment operations ...more |