Revolutionizing Banking Operations: The Unmatched Appeal of Lusis Payments' TANGO Platform4/18/2024

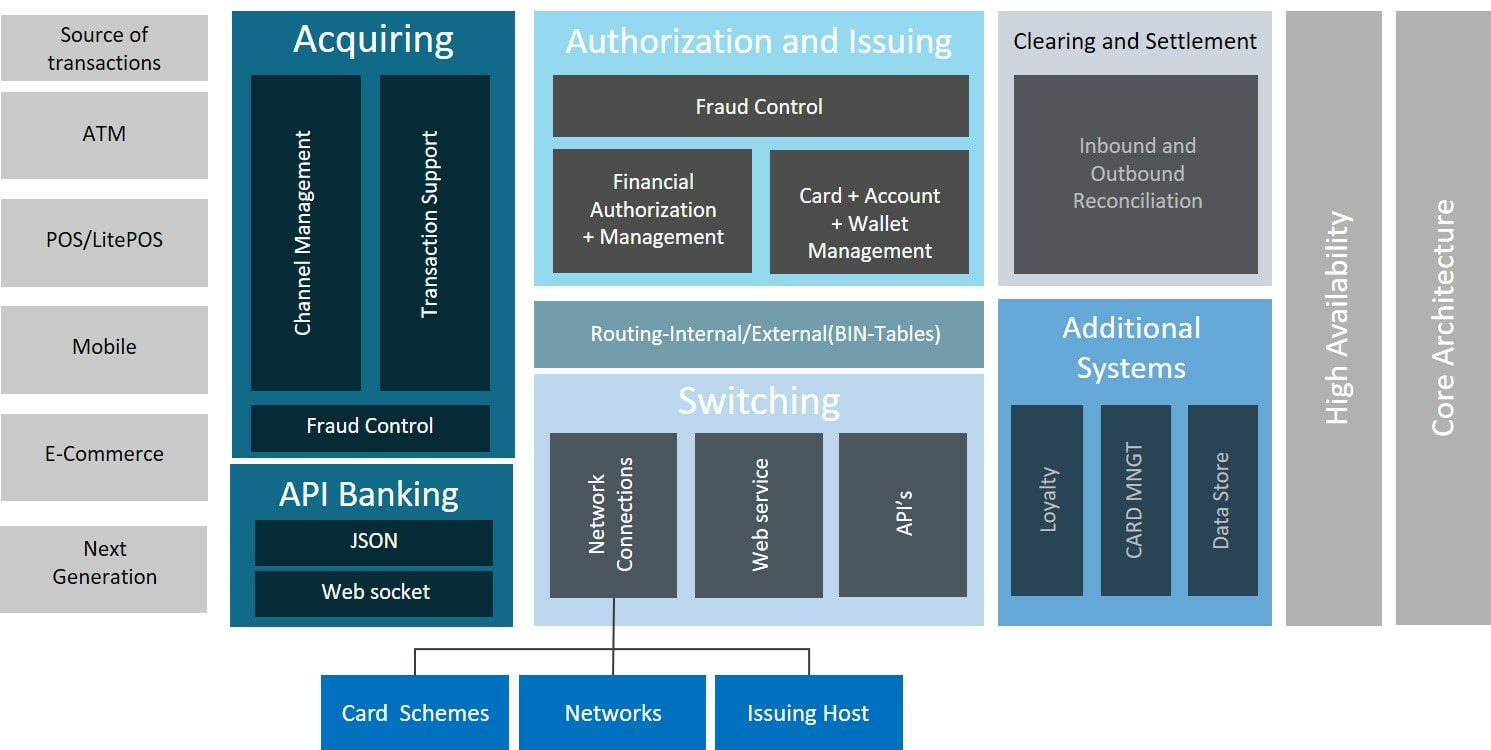

In the fast-paced world of banking, where innovation is not just an option but a mandate, selecting the right technology partner can make or break an institution's success. Amidst this backdrop, Lusis Payments has emerged as a beacon of innovation, with its flagship product, TANGO, revolutionizing the payments landscape. Let’s delve deeper into why four of the top ten banks globally have made the strategic decision to entrust their payments infrastructure to Lusis Payments and the transformative capabilities of the TANGO platform. The Imperative for Transformation: Banks today are navigating through a myriad of challenges, from evolving customer expectations to regulatory complexities and fierce competition from fintech disruptors. In this era of digital transformation, the payments infrastructure serves as the cornerstone of banking operations, demanding agility, scalability, and robustness. Recognizing the urgency for modernization, leading banks are turning to Lusis Payments and TANGO to stay ahead of the curve and drive innovation. Unveiling TANGO's Superiority: Scalability and Performance: At the heart of TANGO lies a foundation of unmatched scalability and performance. In an era where transaction volumes are scaling exponentially, banks cannot afford bottlenecks or downtime. TANGO's architecture is meticulously crafted to handle massive transaction throughput seamlessly, ensuring optimal performance even during peak loads. Whether processing tens of thousands of transactions per second or handling complex payment types, TANGO delivers unparalleled scalability without compromise. Modularity and Flexibility: No two banks are alike, each with its own set of requirements and operational nuances. TANGO's modular micro-service design offers banks the flexibility to tailor the platform to their specific needs, seamlessly integrating with existing systems and workflows. Whether it's deploying new payment channels, complying with regulatory mandates, or enhancing fraud detection capabilities, TANGO empowers banks with the agility to adapt and innovate rapidly. Real-time Processing and Instant Payments: The era of waiting days for payments to clear is long gone. TANGO enables banks to embrace real-time processing, facilitating instant payments that meet the expectations of today's digitally savvy consumers. Whether it's peer-to-peer transfers, merchant settlements, or corporate disbursements, TANGO empowers banks to offer frictionless, real-time payment experiences while ensuring compliance with regulatory mandates. Advanced Analytics and Insights: In the age of big data, deriving actionable insights from payment data is paramount for driving informed decision-making and delivering personalized experiences. TANGO's advanced analytics capabilities leverage machine learning algorithms to analyze transaction patterns, detect anomalies, and uncover valuable insights. By harnessing the power of data, banks can gain a deeper understanding of customer behavior, mitigate risks, and capitalize on emerging trends, thereby gaining a competitive edge. Security and Compliance: With cyber threats on the rise and regulatory scrutiny intensifying, banks must prioritize security and compliance in their payments infrastructure. TANGO incorporates state-of-the-art security protocols, including robust encryption, multi-layered authentication, and comprehensive audit trails, to safeguard sensitive financial data and mitigate the risk of fraud. Moreover, TANGO's compliance module ensures adherence to global regulatory standards, providing banks with peace of mind and mitigating the risk of penalties or reputational damage. Success Stories of TANGO Adoption: The decision to embrace TANGO, especially when hosted on HPE NonStop, has yielded tangible results for banks worldwide, driving operational efficiency, enhancing customer satisfaction, and fueling growth. From accelerated transaction processing times and reduced operational costs to increased revenue opportunities and improved regulatory compliance, the impact of TANGO on HPE NonStop is evident across various facets of banking operations. In a landscape defined by relentless change and fierce competition, the choice of payments software platform is a strategic imperative for banks seeking to thrive in the digital age. Lusis Payments and its revolutionary TANGO platform have emerged as the preferred solution for top banks globally, offering unmatched scalability, flexibility, performance, and security. By harnessing the power of TANGO, banks can unlock new avenues for innovation, differentiation, and growth, positioning themselves at the forefront of the financial services industry. As the journey towards digital transformation accelerates, TANGO remains a catalyst for change, empowering banks to navigate the complexities of modern banking with confidence, agility, and resilience. Pioneering Security with Exclusive Fraud Prevention Technology on the HPE NonStop Platform1/16/2024

In the dynamic landscape of digital transactions, the imperative to secure financial data has reached unprecedented heights. Lusis Payments, a frontrunner in payment software solutions, stands out as a pioneer in fraud prevention, particularly on the HPE NonStop platform. This article explores the intricate details of fraud prevention on HPE NonStop, highlighting the innovative features offered exclusively by Lusis Payments and shedding light on the unique benefits of operating on the HPE NonStop infrastructure. Fraud Prevention on the HPE NonStop Platform: The HPE NonStop platform, renowned for its reliability, scalability, and fault-tolerance, has become the platform of choice for mission-critical applications in the financial sector. Lusis Payments has strategically harnessed the strengths of this platform to develop fraud prevention solutions that seamlessly integrate with its unique architecture.

Benefits of Being on the HPE NonStop Platform:

Exclusivity with Lusis Payments: Lusis Payments proudly stands as the exclusive provider of payments fraud prevention technology on the HPE NonStop platform. With a singular focus on delivering top-notch security solutions tailored for this unique environment, Lusis Payments has solidified its position as the go-to partner for financial institutions seeking unparalleled protection against fraud. Collaboration with Lusis AI: In a testament to its commitment to innovation, Lusis Payments collaborates closely with Lusis AI, its dedicated artificial intelligence division. This collaboration is instrumental in enhancing the efficacy of fraud prevention solutions. Lusis AI's expertise in developing intelligent algorithms and predictive models contributes significantly to strengthening Lusis Payments' ability to stay ahead of evolving fraud landscapes. Additionally, it's worth noting that Lusis Payments employs the BackTest Engine (BTE), also known as the sandbox for testing. This tool ensures rigorous testing of rules before they are moved into a repository for production, effectively utilizing a fully integrated approach with TANGO for acquiring and issuing. Conclusion: As financial transactions continue to evolve, Lusis Payments and the HPE NonStop platform stand as steadfast guardians, ensuring that the future of digital payments remains secure and resilient. The combined forces of Lusis Payments' cutting-edge fraud prevention software, tailored exclusively for the HPE NonStop environment, and the inherent benefits of operating on this platform create a formidable defense against the ever-present threat of fraud. The seamless integration, fault-tolerant architecture, and scalability of both entities contribute to a secure and efficient environment for financial institutions and businesses. In this collaborative pursuit of security and innovation, Lusis Payments, as the exclusive provider of fraud prevention technology on HPE NonStop, redefines the landscape of digital transactions, setting new standards for the intersection of technology, security, and financial integrity. When considering the world of data management and databases, one may not immediately associate it with excitement. However, the realm of HPE NonStop SQL/MX offers a unique perspective that can pique the interest of buyers and technology enthusiasts alike. This article delves into the importance of NonStop SQL/MX and its relevance in today's rapidly evolving computing landscape. The Symbiotic Relationship Between Software and Hardware In the realm of computing, the relationship between software and hardware has always been of great significance. This synergy can profoundly impact the performance, reliability, and scalability of applications. NonStop SQL/MX embodies this synergy by providing a database solution optimized to work seamlessly with HPE's NonStop hardware platform. Just as a finely crafted beer requires the right container to preserve its quality, data deserves a database technology that ensures its integrity, availability, and performance. A Journey Through Computing History To appreciate the evolution of NonStop SQL/MX, it's worth taking a brief journey through computing history. From the early days of personal computers, where enthusiasts used Apple IIe computers for various tasks, to more complex endeavors involving minicomputers like the HP 3000, our experiences reflect the ever-changing landscape of computing. Fast forward to the early 80;s ', where we encountered the NonStop platform and Enscribe for the first time. At that time, “Tandem” or "NonStop" primarily referred to the hardware platform. Today, it has evolved into a software solution that adapts to the cloud-centric computing world. The Cloud-Centric World and Abstracted Applications In today's cloud-centric environment, applications are abstracted from the underlying hardware and operating systems. Tools like Docker and Kubernetes enable elastic scaling, making it easy to provision computing resources on-demand. The complexities of the infrastructure are hidden behind user-friendly interfaces, and users focus on the benefits of the applications. If we need more computing resource, then we just load up the Azure portal and configure a virtual machine with the exact specifications that we need. Just by clicking check boxes.

The Future of NonStop: A Checkbox on the Horizon? In this modern landscape, one might wonder if we will ever see a "NonStop" checkbox option in cloud platforms. While we don’t have a crystal ball, the potential benefits of NonStop fundamentals being more accessible are clear. Businesses can leverage this technology for applications requiring high availability, scalability, and fault tolerance. The True Challenge: Data Management However, the selection of technical infrastructure is only part of the equation. The true challenge lies in data management. The advent of Data Sovereignty, GDPR, and Cyber Terrorism are just some of the latest challenges impacting data management policies and governance. Speaking frankly, the mountain of regulation surrounding data management is extremely intimidating. With hindsight, the checkbox that users may really like to see on an Azure portal is “Access to helpful data management expert?”. HPE GreenLake: A Differential Benefit It becomes evident that HPE GreenLake offers a differential benefit compared to commodity cloud service providers. While giants like Amazon, Microsoft, and Google provide powerful cloud solutions, HPE's partnership with industry vertical leaders, such as Lusis Payments for Retail Payments, sets it apart. This partnership extends HPE's multi-decade excellence as the custodian of the NonStop spirit into the realm of cloud computing. Click. In Closing The journey through computing history underscores the importance of databases like NonStop SQL/MX in modern computing. While the checkbox for NonStop on a cloud portal may be close, it is not here today, the value of data management expertise and strategic partnerships cannot be overstated. HPE's legacy in the world of NonStop computing and its innovative GreenLake offering hold the promise of exciting years ahead in the ever-evolving world of technology. In 2012, Lusis Payments conducted a historic proof of concept with partner HPE at the HP ATC (advanced technical center) in Palo Alto, CA. TANGO was tested for 48 hours straight at full capacity. The system processed 2,500 TPS without fail. The hardware configuration used at the time of the benchmark was chosen to match a client’s production system and consisted of a 8-processor HPE J-series NonStop. TANGO proved responsive and surpassed normal daily tasks and nightly settlements. This proof of concept proved that TANGO was fault tolerant and achieved maximum volumes and throughput of a total daily volume of 50 million transactions per day.

The outstanding results came from long hard-working sessions with the HPE teams which we were proud to work with. The first week included our CTO working on-site. Soon after, he was joined by our senior project leaders, and they received significant additional support from our lab in Paris. In addition to the dedicated HPE team, the client’s team also partnered with us to test the conformity of the benchmark protocol. HPE worked with the client to reproduce its environment for a true simulation. It was great project, and we were proud of the outcome. Since then, HPE has continued to suggest that we test TANGO on the newest (Intel based chip) hardware. As we were still quite pleased with the 2500TPS results and the fact that the client continued to realize improved performance on their HPE NonStop platform, we chose not to do additional test campaigns in subsequent years. Until now. At the end of Q1 we said “ok, let’s do it”! At that time, bandwidth was quite low, so we made it “our dry way of doing it.” We used our Vanilla switch based on the TANGO version 7 platform installed on HPE NS server: 8 processor, 6 core NS7-X3 system again at the HP ATC labs. This system runs OS release L21.06.17.2 with NonStop SQL/MX 3.7.2. Each NonStop processor contained 256 GB of memory. We used a very similar testing protocol without any specific tunning. And “Torpedo… LOS”! On our first run we achieved 3,500 TPS. Then with less than 10 hours of tuning, we easily reached 4,500 TPS sustained for two straight hours. So, this has become our new reference on HPE NonStop: 4,500 transactions per second on an 8-CPU machine. And this was simply done with our Vanilla switch and some very light tuning. So, nothing heroic, just the standard product using a standard configuration. In Q3, we will test TANGO with the new Posix Kernel of HPE NonStop and see where we take it! Stay tuned. Philippe Préval Lusis CEO Chez Lusis Please sign up ahead of time for our presentation: Today’s Payments Market: Creating Opportunities from Challenges - November 17th at 12:15 PM PST. Payment processing today is evolving at a rapid rate. It’s not just the technology, allowing more transactions to be generated through new channels. New players are constantly emerging in the marketplace and using new technology to provide exciting new financial services to consumers, who are less loyal to traditional financial institutions and are more demanding than ever. Organizations with legacy solutions face increasing costs to maintain/extend while requiring months/years of hard coding for development of new products for market. To keep pace in a dynamic industry and outperform competitors, you need modern, flexible solutions that help streamline new offerings. This presentation introduces TANGO from Lusis Payments, a state-of-the-art technology with unparalleled configurability provided by its microservices-based architecture. TANGO facilitates the rapid introduction of new business and technical services, enables seamless integration with in-house and third-party applications, and facilitates support for current and future payment components. These features combine not only to address today’s challenges, but also to create a modern payments platform to benefit from further technology and business advancements that will inevitably occur in the future. TANGO’s architecture deeply integrates with some of the modern and core fundamentals of HPE NonStop such as use of OSS and TMF-protected SQL/MX database, and full exploitation of HPE NonStop “process pair” feature through its hypervisor process. The dispatcher functionality works together with HPE NonStop TS/MP to provide scalability and availability, and supports the active/active configuration. This further establishes HPE NonStop as one of the most ideal platforms to run your TANGO payments solution. Be sure to check out our presentation on November 17th at 12:15 PM PST at the NonStop Technical Boot Camp or visit: lusispayments.com/onewebcast to schedule a one-on-one Zoom call. |

lUSIS nEWSThe latest company and industry news from Lusis Payments. Archives

June 2024

Categories

All

|

RSS Feed

RSS Feed