|

The card-based payments mechanism has evolved over many decades and is now a commonplace experience for both the consumer and merchants. Recently there has been a steady stream of new payment innovations, though none has yet to achieve the ubiquity of the traditional card. So what near-term changes can we expect in the US market in how consumer payments are conducted? In this paper we will be looking at potential drivers for change, specifically;

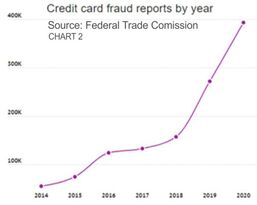

From a technology perspective it is reasonable to assume that the necessary ingredients and know-how currently exists to build any form of consumer payments system. Cloud-computing, strong encryption, AI and machine learning, blockchain, crypto-currencies, and digital wallets, are all ingredients for a new era in consumer payments. However, it is not the technology that will ultimately determine the direction of consumer payments but rather who stands to benefit within the payments ecosystem. So who might benefit from a new consumer payments method and who might lose out? The rampant fraud losses rightfully creates great concern. There is a deep, moral instinct that kicks in when the 'bad-guys' seemingly get away with criminal gains. There is certainly some great AI and machine learning technologies emerging that are creating tangible reductions in fraud levels. However, one of the great challenges of fraud detection and prevention is that fraud evolves. Card fraud is no longer the purview of chancers and petty thieves, it has become the domain of sophisticated, organized crime gangs with the capability to probe security defenses and rapidly exploit any vulnerabilities. The irony is that despite more and more consumers being impacted by card-related fraud the popularity and increased usage of credit cards suggests there are still significant gains to be made by the card processing networks and card issuers. With commercial factors being what they are, card processing organizations are under no obligation to eliminate fraud. Provided that the losses are sufficiently small relative to the financial gains then the quest for more growth becomes the priority. Given the healthy profits associated with card processing and its apparent entrenchment into the commercial fabric it begs the question - “is there sufficient pressure for change?” Consumers who are subjected to card fraud often face significant inconvenience trying to recover lost funds and restore reputations. With the current levels it is reasonable to assume that consumers are becoming increasingly open to alternate payment methods. However, consumer dissatisfaction cannot of itself introduce a new payments option. We need another trigger point. The question of interchange fee rates has been a long running battle between retailers, card issuers, and the networks. Retailers have long held the view that they are being gouged over interchange fees and service charges. In 2021, the Global Payments Consulting firm GMSPI issued a comprehensive report highlighting the dramatic imbalance in commercial profits experienced by the different players in the card-payments chain.

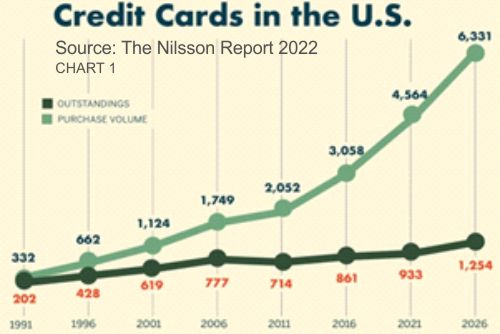

“Do you take plastic?”

There was a time when consumers were asking that question in Retail outlets around the world. Nowadays, the ability to pay for goods and services with a debit or credit card is so commonplace that consumers simply assume that card acceptance is available virtually everywhere. It wasn’t always like this but several decades of investment has built the card payment infrastructure to its current state. However, despite the continued growth in consumer payment transactions, card payments does have its drawbacks. The level of fees paid by merchants has been a long standing area of contention, often resulting to protracted legal action to enforce greater billing transparency and reductions in overall fee costs. Another area of serious concern is the dramatic increase in card and account fraud, clearly aggravated by consumer behavior changes during the pandemic. Of course, the quest for ever simpler and more secure payment options is of great interest to many consumers. There has been a lot of payments innovation over the years including stored value cards, digital wallets, and bio-metric authentication. However, many of these schemes piggyback on the card infrastructure or achieve only limited levels of success. In most industries technology has been reinventing itself at accelerating rates but this is not the case with card payments. This begs the question – “Is the card itself the bottleneck to change?” Putting aside the entire settlement cycle there are several key elements that a truly alternative consumer payments option needs to address. Firstly, the consumer needs to have some form of payment token and authentication method. Additionally, the alternate payment scheme needs to ensure the secure acquisition and routing of the payment to the appropriate institution for authorization. The advent of smartphones and wearable computing, coupled with the growth of real time account to account payments is already proving to be an interesting possible alternative to card payments. Some adoption rate projections suggest that account-based payments could notionally obsolete card-based payments. It seems that the real hurdle to obsoleting card payments is a commercial issue, not a technical one. As long as the new entrants into the consumer payments market all seek their own “magic bullet” then they are most likely to be left nibbling around the market share of the traditional card brands. The last thing consumers want is to be drip-fed an endless array of different payment options with no clear indication of convergence and interoperability. The electric car market provides a great comparison in this regard. In an age of climate change and excessive wastage it seems obvious that governments should demand all electric cars sold in their country to have the same charging connection. The cost and timescales to create an effective charging stations infrastructure is immediately reduced, and consumers would have greater confidence to switch to electric cars. I have no doubt that were the governments of a few of the major market countries to take this bold step it would be universally applauded and the card manufacturers would deliver the requisite standards in a heart beat. The US market saw a strong consortium of banks cooperate in the launch of Zelle as a competitive counter to Venmo. However, the really big question is whether the banks, Fintechs, and Retailers can cooperate to deliver a single, ubiquitous consumer payments option that can move us beyond the 70 years history of plastic cards. |

lUSIS nEWSThe latest company and industry news from Lusis Payments. Archives

June 2024

Categories

All

|

RSS Feed

RSS Feed