|

The card-based payments mechanism has evolved over many decades and is now a commonplace experience for both the consumer and merchants. Recently there has been a steady stream of new payment innovations, though none has yet to achieve the ubiquity of the traditional card. So what near-term changes can we expect in the US market in how consumer payments are conducted? In this paper we will be looking at potential drivers for change, specifically;

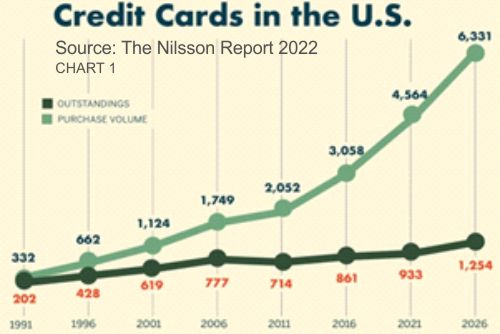

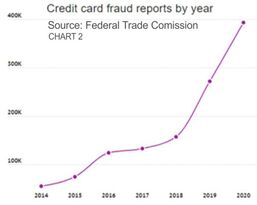

From a technology perspective it is reasonable to assume that the necessary ingredients and know-how currently exists to build any form of consumer payments system. Cloud-computing, strong encryption, AI and machine learning, blockchain, crypto-currencies, and digital wallets, are all ingredients for a new era in consumer payments. However, it is not the technology that will ultimately determine the direction of consumer payments but rather who stands to benefit within the payments ecosystem. So who might benefit from a new consumer payments method and who might lose out? The rampant fraud losses rightfully creates great concern. There is a deep, moral instinct that kicks in when the 'bad-guys' seemingly get away with criminal gains. There is certainly some great AI and machine learning technologies emerging that are creating tangible reductions in fraud levels. However, one of the great challenges of fraud detection and prevention is that fraud evolves. Card fraud is no longer the purview of chancers and petty thieves, it has become the domain of sophisticated, organized crime gangs with the capability to probe security defenses and rapidly exploit any vulnerabilities. The irony is that despite more and more consumers being impacted by card-related fraud the popularity and increased usage of credit cards suggests there are still significant gains to be made by the card processing networks and card issuers. With commercial factors being what they are, card processing organizations are under no obligation to eliminate fraud. Provided that the losses are sufficiently small relative to the financial gains then the quest for more growth becomes the priority. Given the healthy profits associated with card processing and its apparent entrenchment into the commercial fabric it begs the question - “is there sufficient pressure for change?” Consumers who are subjected to card fraud often face significant inconvenience trying to recover lost funds and restore reputations. With the current levels it is reasonable to assume that consumers are becoming increasingly open to alternate payment methods. However, consumer dissatisfaction cannot of itself introduce a new payments option. We need another trigger point. The question of interchange fee rates has been a long running battle between retailers, card issuers, and the networks. Retailers have long held the view that they are being gouged over interchange fees and service charges. In 2021, the Global Payments Consulting firm GMSPI issued a comprehensive report highlighting the dramatic imbalance in commercial profits experienced by the different players in the card-payments chain.

Meet Dave Smith, Payments Specialist with Lusis Payments’ European team.  Q: Let’s kick off with a direct question - the payments, and more broadly the financial sector, is facing a myriad of challenges, would you say you’re optimistic about what the future holds? Dave: Definitely. I’ve been in the financial sector for a long time, and I’ve seen waves of economic, social and technology events that all threaten to completely rock the sector. But this is an incredibly resilient industry - one of the pioneers of technology in business. We’re at our best when we’re putting customers first, developing products that help them in their lives, and enabling the global economy to function - payments are central to that. That makes me very optimistic about the future of payments - powered by technology. At the end of the day, payments are at the heart of the way we live, and that makes them central to an organisation’s reputation. Q: You say that payments are at the heart of the way we live, do you think banks recognise that enough as they look for new revenues and business models? Dave: There can be a mindset within banks that see payments as a commodity or utility. I think that’s a big mistake, because if you take payments away then the rest of the banking infrastructure loses a sense of purpose. Banks can sometimes see it more as a chore that the central bank makes them handle than what it really is - a direct connection to the customer. That’s when they run the risk out trying to outsource it to another institution. Big mistake. Consumers want banks to handle payments. It’s one of the most trusted aspects of banking - that you help me move my money, pay my mortgage, get cash out or buy goods and services. The trick is to turn that into an effective business model, which, with the right infrastructure, is very achievable for almost every financial services institution out there today. Q: What challenges do you see banks facing in terms of their business models? Dave: There was a massive acceleration pre-pandemic of online only banking - not just the challengers we see in the UK and Europe, but also traditional banks who would offer you an extra half a percent of interest in order to bank online and not use a branch. So managing a physical footprint is certainly on the list. On top of that, you have a new generation of consumers who will live very differently than those before. More subscription services and less ownership, more renting homes and less buying. That has a knock on effect for the range of other financial services products banks typically facilitate - from mortgages to insurance. There has been a continued depression of interest rates which means the classic business model of banks taking and lending money is more difficult than before. On the other hand, transaction volumes have gone up hugely in the pandemic. However, banks haven’t necessarily been the quickest to respond with new products and services (and I include challengers in that too to a certain extent), in part because of regulation but also because they didn’t have the right infrastructure in place to move rapidly. Q: What role do you think regulators do, and should, play in the development of payments going forwards? Dave: Regulations can create opportunity for the financial services sector, often in how they govern consumer service levels. Faster Payments is a great example of that - people want to get their money instantly (and in a 24/7 world why would they not!) and so it helps focus technology and innovation on meeting those wants and needs. Q: What’s the big infrastructure challenge that’s holding banks back from seizing these opportunities? Dave: At the end of the day, too many financial institutions are using technology that is seriously outdated, and wasn’t built for the range of scenarios that we see now. Challenger banks that only came onto the market a few years ago are already rebuilding their infrastructure, so it makes no sense that you’d have a big name bank that’s using technology someone purchased in the 70s or 80s to run significant parts of their systems. The name of the game is flexibility. You need to put infrastructure in place that can survive any unknown scenario. No one in banking predicted the challenges that 2020 would bring - but too often they only build technology that copes with the scenarios they know about. Banks need a new approach - they need to build for uncertainty, for flexibility and for an unknown future. Then you get resilience. Whether they rip and replace, or take a bit-by-bit approach, is completely down to their needs, but something needs to change. Quickly.

By Fabrice Daniel, Artificial Intelligence Department of Lusis, Paris, France http://www.lusisai.com ABSTRACT

Combining evidence from different sources can be achieved with Bayesian or Dempster-Shafer methods. The first re-quires an estimate of the priors and likelihoods while the second only needs an estimate of the posterior probabilities and enables reasoning with uncertain information due to imprecision of the sources and with the degree of conflict between them. This paper describes the two methods and how they can be applied to the estimation of a global score in the context of fraud detection. INTRODUCTION Fraud detection mainly relies on expert driven methods that implement a set of rules and data driven approaches implementing machine learning (ML) models. Both provide an estimate (or a score) for a new transaction to be fraudulent. While each ML model naturally returns a fraud probability, the experts can also attach a probability to each rule. They can also be automatically calculated from the labeled his-tory. Combining them together produces a global score that can be used in a near real time system to rank a set of trans-actions having the highest probability to be fraudulent. By obtaining this ranking, investigators can concentrate their efforts on the suspect transactions with the highest probability of being true frauds. The most common approaches for combining scores are summing individual scores or returning the highest score among the trigged rules. This is not entirely satisfactory given that summing scores is equivalent to averaging the probabilities returned by each predictor (rule or model). It also does not take into account the uncertainty of each predictor and the degree of conflict between them. For the Lusis fraud system, we work on implementing more appropriate approaches. This paper proposes two ways for addressing this problem. The first is to use Bayesian methods [5]; the second is to combine the scores by using Dempster-Shafer theory [6]. As the end of the year draws near we would like to take the opportunity to thank all of our clients, partners and teammates for an extraordinary year, amidst the challenges of the global coronavirus pandemic which has affected families, businesses and communities. Our thoughts go out to anyone who has been impacted by the virus especially those who are sick, we extend our heartfelt wishes for a full recovery.

We have always said “we hold our clients central to our thinking and our actions” and that statement holds true this year more than ever. The success of Lusis Payments is based on the relationships we have built over the years, and we really wouldn’t be where we are without you. Over this past year, as more and more North American financial institutions have called upon Lusis Payments for our technology and services we added our first North American support center in Toronto Canada and have made NA our primary market. Until this year, Lusis had only sales and consulting teams in North America. The addition of this facility and the team assembled will dramatically accelerate new and current project deployments of TANGO. The need for a cutting-edge, real-time fraud solution has never been so critical as it is now. The world has seen an unprecedented switch from CP (cardholder present), CNP (cardholder not present) to online transactions, which has massively changed the patterns of fraudulent activity for OLTP (online transaction processing). Our clients that process online payments needed the agility to rapidly counteract this industry swing. This year Lusis introduced TANGO AI Fraud (Tango AIF™) to provide a leading-edge solution for fraud monitoring, detection and action — technology that provides the latest methods for processing secure transactions, irrespective of source, nature or market segment. The development has followed years of dedication by our Artificial Intelligence department, created in 2017. As part of our continued dedication to AI, earlier this year Lusis created a research chair in partnership with CentraleSupélec a prestigious French graduate engineering school of Paris-Saclay University. Through this partnership, Lusis and CentraleSupélec are strengthening their collaboration in the field of artificial intelligence applied to the banking sector. This summer Lusis also announced further expansion as we increased our presence in Mexico and select countries of Latin America. We were excited to introduce Mercedes Fabila as the newest addition to our sales executive team. Fabila joined the company as the Director of Sales, Mexico and Latin America. Our most exciting news for the year was the new release of TANGO Version 8. TANGO V8 is a major upgrade that provides full microservice integration and complete Cloud capacities. The new features bring expanded capacities and even greater flexibility for delivery. Please contact us directly for a one-on-one presentation of TANGO’s full capabilities and new capacities. Recently, we were able to interact with several clients, partners and friends during the Virtual NonStop Technical Bootcamp. Through zooms or instant messages, we were happy to answer questions and be able to say hello to colleagues in the industry. Our presentation “Today’s Payments Market: Creating Opportunities from Challenges” is still available for viewing through the Whova app. As the new year approaches, we know there will be many new challenges ahead. We welcome all that 2021 has in store for us with enthusiasm and anticipation for all the opportunities around the world. From the whole team at Lusis Payments we wish you all Happy Holidays!

Romain Soubeyran, Managing Director of CentraleSupélec and Philippe Préval, Managing Director of Lusis, launch the Chair "Artificial intelligence applied to the detection of payment fraud and trading". Through this partnership, Lusis and CentraleSupélec are strengthening their collaboration in the field of artificial intelligence applied to the banking sector. Lusis is the publisher of TANGO, a high-performance payments transaction platform for the finance industry. With the TANGO platform, Lusis provides a complete retail payment system that includes fraud detection, as well as extremely rich and complex “front to back” trading platforms.

In order to give a formal framework to this permanent R&D approach, in June 2017 Lusis created an Artificial Intelligence department responsible for working on Machine Learning / Deep Learning approaches mainly applicable to fraud detection on payments and trading strategies in the financial markets. For its part, CentraleSupélec gives very high priority to artificial intelligence by dedicating focus to a of 3rd year to AI. The laboratories of CentraleSupélec are also present in this field by participating in numerous projects. This chair is the first signed by CentraleSupélec with a French high tech SME. Strong involvement of students and researchers Thanks to the long-standing collaboration between Lusis and CentraleSupélec, the student-engineers of the School have the opportunity to carry out, within the framework of "industrial study contracts" (« contrats d’étude industrielle » CEI), projects that focus on solving complex problems using statistical or machine learning approaches. Involving students allows Lusis to generate and capture new ideas created in the laboratory that are usable in industrial approaches, and to access a pool of skills (researchers, students and collaboration network) conducive to the development of the various projects carried out. Scientific objectives and research themes The Chair supported by Lusis and CentraleSupélec provides a structured working framework allowing the two partners to carry out research work of specific interest by relying on a dedicated research team. It is housed in the Computer Science Research Laboratory (LRI), a joint research unit at Paris-Saclay University, CNRS and CentraleSupélec. The themes studied include the detection of fraud on payments and trading strategies. As far as fraud detection is concerned, the essential points to take into account are both the appearance of new fraud strategies and the essentially online nature of the process, as well as the ability to provide an explanation for the refusal or the acceptance of a transaction. With regard to trading strategies, the work undertaken highlights the share of random time series in financial market data. This is the major difficulty of research in this area. "Artificial intelligence is a game changer in the world of IT and business in general. It will completely redraw the landscape of whole sections of the industry. We want Lusis to be part of this revolution, particularly in our preferred areas of trading, payments systems, on-line banking, and customer-centric programs. For us, being an AI player means being a stakeholder in AI research. This is why, we are both happy and proud to be able to give a new dimension to our long-standing partnership with CentraleSupélec. Our teams like those set up by CentraleSupélec are enthusiastic about exploring these new universes,” declares Philippe Préval, CEO of LUSIS. “Artificial intelligence is a young science whose recent successes and advances open up enormous potential for innovation in all fields and sectors of activity, which is at the heart of CentraleSupélec's strategy. We train, through dedicated courses, the engineers and researchers who will build tomorrow's intelligent systems at the service of society. With a wide disciplinary variety, our research activities cover a wide spectrum of AI," says Romain Soubeyran, Managing Director of CentraleSupélec who adds"The artificial intelligence chair applied to the detection of payment fraud and trading with LUSIS allows us to reinforce this strategy with a very ambitious scientific program.” About CentraleSupélec CentraleSupélec is a public scientific, cultural and professional establishment, born in January 2015 of the merger of École Centrale Paris and Supélec. Today, CentraleSupélec consists of 3 campuses in France (Paris-Saclay, Metz and Rennes). It has 4,300 students, including 3200 engineering students, and brings together 16 laboratories or research teams. strongly internationalized (30% of its students and almost a quarter of its international teaching staff), the school has established over 170 partnerships with the best institutions in the world. Leading school in higher education and research, CentraleSupélec is a benchmark center in the field of engineering and systems sciences, ranked among the best institutions world. It is a founding member of Paris-Saclay University and chairs the Groupe des Ecoles Centrale (Lyon, Lille, Nantes and Marseille), which operates international establishments (Beijing (China), Hyderabad (India), Casablanca (Morocco)). www.centralesupelec.fr About Lusis Lusis is a technology supplier allowing to implement solutions of: • Payment HUB • Trading • Advanced messaging • Fight against fraud Lusis payments is a major player in the payments world. We focus on R&D, innovation, performance, time to market, disruption. We take advantage of SCRUM both for our developments and for the projects we carry out with our customers. The architecture of our micro-service (Tango) solution and benefits from a constant investment of R&D on new payments, AI, distributed ledgers, performance. We have clients all over the world, operating directly or through partnerships from: • Paris: HQ, R&D • London: EMEAA Sales • San Francisco: America’s sales |

lUSIS nEWSThe latest company and industry news from Lusis Payments. Archives

June 2024

Categories

All

|

RSS Feed

RSS Feed