|

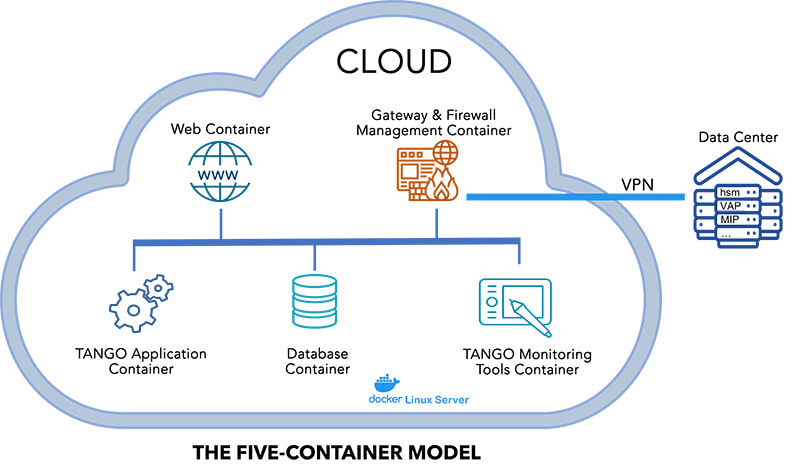

TANGO is the world's most performant Retail Payments solution with benchmark tests demonstrating 10,000 transactions per second. Built using a micro-services architecture, TANGO is also feature-rich and easily extensible. Backed by Lusis' proven track record it is not surprising that more and more organizations are swapping out their legacy payments infrastructure for TANGO. TANGO is the culmination of decades of crafted engineering that ensures the maximum operational performance and reliability as well as the most affordable cost of ownership. For example, TANGO includes a Self-Monitoring and Auto-Spawning feature whereby a suite of timers can be configured to monitor the processing time for specific events. By comparing the real-time measurements against the defined norms TANGO can immediately identify bottlenecks as soon as they occur. TANGO can also be configured to automatically spawn new instances of the affected micro-service or process thereby ensuring the required throughput is maintained. TANGO uses the Docker containerization platform and a typical deployment uses the 5-Container model shown below. Significantly, the container boundaries are defined to simplify manageability. For example, the gateways and firewalls are combined in a single container to simplify PCI certification tasks. Equally, the monitoring and other tools are located in a dedicated container to ease system evolution. This approach has numerous benefits, not least of which is that it is well proven and supports the easy and secure use of cloud infrastructure. However, in this model, container creation is still a manual process. Consequently, Lusis has expanded TANGO's container model to deliver the full elastic scalability advantages of a cloud-native environment.

As the end of the year draws near we would like to take the opportunity to thank all of our clients, partners and teammates for an extraordinary year, amidst the challenges of the global coronavirus pandemic which has affected families, businesses and communities. Our thoughts go out to anyone who has been impacted by the virus especially those who are sick, we extend our heartfelt wishes for a full recovery.

We have always said “we hold our clients central to our thinking and our actions” and that statement holds true this year more than ever. The success of Lusis Payments is based on the relationships we have built over the years, and we really wouldn’t be where we are without you. Over this past year, as more and more North American financial institutions have called upon Lusis Payments for our technology and services we added our first North American support center in Toronto Canada and have made NA our primary market. Until this year, Lusis had only sales and consulting teams in North America. The addition of this facility and the team assembled will dramatically accelerate new and current project deployments of TANGO. The need for a cutting-edge, real-time fraud solution has never been so critical as it is now. The world has seen an unprecedented switch from CP (cardholder present), CNP (cardholder not present) to online transactions, which has massively changed the patterns of fraudulent activity for OLTP (online transaction processing). Our clients that process online payments needed the agility to rapidly counteract this industry swing. This year Lusis introduced TANGO AI Fraud (Tango AIF™) to provide a leading-edge solution for fraud monitoring, detection and action — technology that provides the latest methods for processing secure transactions, irrespective of source, nature or market segment. The development has followed years of dedication by our Artificial Intelligence department, created in 2017. As part of our continued dedication to AI, earlier this year Lusis created a research chair in partnership with CentraleSupélec a prestigious French graduate engineering school of Paris-Saclay University. Through this partnership, Lusis and CentraleSupélec are strengthening their collaboration in the field of artificial intelligence applied to the banking sector. This summer Lusis also announced further expansion as we increased our presence in Mexico and select countries of Latin America. We were excited to introduce Mercedes Fabila as the newest addition to our sales executive team. Fabila joined the company as the Director of Sales, Mexico and Latin America. Our most exciting news for the year was the new release of TANGO Version 8. TANGO V8 is a major upgrade that provides full microservice integration and complete Cloud capacities. The new features bring expanded capacities and even greater flexibility for delivery. Please contact us directly for a one-on-one presentation of TANGO’s full capabilities and new capacities. Recently, we were able to interact with several clients, partners and friends during the Virtual NonStop Technical Bootcamp. Through zooms or instant messages, we were happy to answer questions and be able to say hello to colleagues in the industry. Our presentation “Today’s Payments Market: Creating Opportunities from Challenges” is still available for viewing through the Whova app. As the new year approaches, we know there will be many new challenges ahead. We welcome all that 2021 has in store for us with enthusiasm and anticipation for all the opportunities around the world. From the whole team at Lusis Payments we wish you all Happy Holidays! |

lUSIS nEWSThe latest company and industry news from Lusis Payments. Archives

June 2024

Categories

All

|

RSS Feed

RSS Feed