|

As the end of the year draws near we would like to take the opportunity to thank all of our clients, partners and teammates for an extraordinary year, amidst the challenges of the global coronavirus pandemic which has affected families, businesses and communities. Our thoughts go out to anyone who has been impacted by the virus especially those who are sick, we extend our heartfelt wishes for a full recovery.

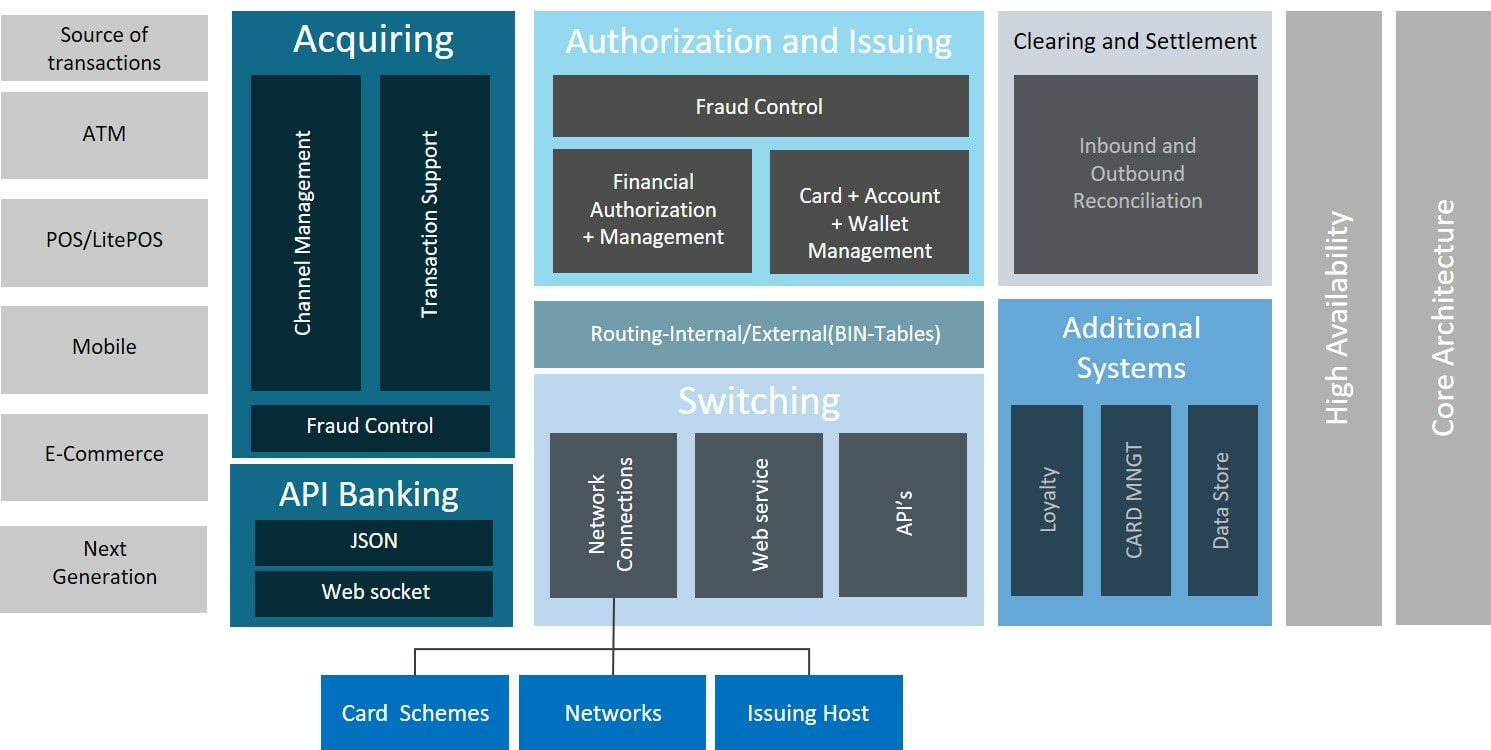

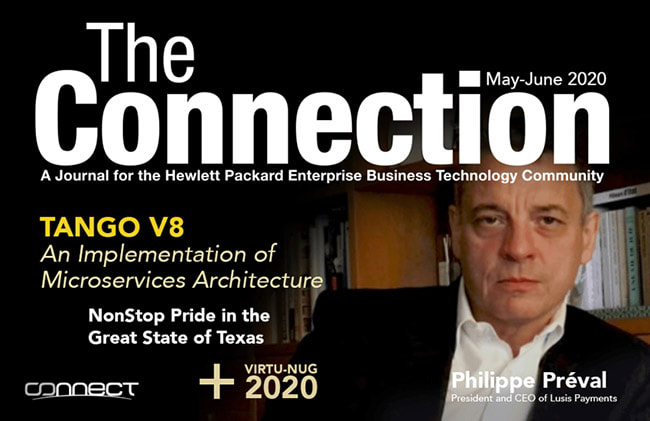

We have always said “we hold our clients central to our thinking and our actions” and that statement holds true this year more than ever. The success of Lusis Payments is based on the relationships we have built over the years, and we really wouldn’t be where we are without you. Over this past year, as more and more North American financial institutions have called upon Lusis Payments for our technology and services we added our first North American support center in Toronto Canada and have made NA our primary market. Until this year, Lusis had only sales and consulting teams in North America. The addition of this facility and the team assembled will dramatically accelerate new and current project deployments of TANGO. The need for a cutting-edge, real-time fraud solution has never been so critical as it is now. The world has seen an unprecedented switch from CP (cardholder present), CNP (cardholder not present) to online transactions, which has massively changed the patterns of fraudulent activity for OLTP (online transaction processing). Our clients that process online payments needed the agility to rapidly counteract this industry swing. This year Lusis introduced TANGO AI Fraud (Tango AIF™) to provide a leading-edge solution for fraud monitoring, detection and action — technology that provides the latest methods for processing secure transactions, irrespective of source, nature or market segment. The development has followed years of dedication by our Artificial Intelligence department, created in 2017. As part of our continued dedication to AI, earlier this year Lusis created a research chair in partnership with CentraleSupélec a prestigious French graduate engineering school of Paris-Saclay University. Through this partnership, Lusis and CentraleSupélec are strengthening their collaboration in the field of artificial intelligence applied to the banking sector. This summer Lusis also announced further expansion as we increased our presence in Mexico and select countries of Latin America. We were excited to introduce Mercedes Fabila as the newest addition to our sales executive team. Fabila joined the company as the Director of Sales, Mexico and Latin America. Our most exciting news for the year was the new release of TANGO Version 8. TANGO V8 is a major upgrade that provides full microservice integration and complete Cloud capacities. The new features bring expanded capacities and even greater flexibility for delivery. Please contact us directly for a one-on-one presentation of TANGO’s full capabilities and new capacities. Recently, we were able to interact with several clients, partners and friends during the Virtual NonStop Technical Bootcamp. Through zooms or instant messages, we were happy to answer questions and be able to say hello to colleagues in the industry. Our presentation “Today’s Payments Market: Creating Opportunities from Challenges” is still available for viewing through the Whova app. As the new year approaches, we know there will be many new challenges ahead. We welcome all that 2021 has in store for us with enthusiasm and anticipation for all the opportunities around the world. From the whole team at Lusis Payments we wish you all Happy Holidays! Please sign up ahead of time for our presentation: Today’s Payments Market: Creating Opportunities from Challenges - November 17th at 12:15 PM PST. Payment processing today is evolving at a rapid rate. It’s not just the technology, allowing more transactions to be generated through new channels. New players are constantly emerging in the marketplace and using new technology to provide exciting new financial services to consumers, who are less loyal to traditional financial institutions and are more demanding than ever. Organizations with legacy solutions face increasing costs to maintain/extend while requiring months/years of hard coding for development of new products for market. To keep pace in a dynamic industry and outperform competitors, you need modern, flexible solutions that help streamline new offerings. This presentation introduces TANGO from Lusis Payments, a state-of-the-art technology with unparalleled configurability provided by its microservices-based architecture. TANGO facilitates the rapid introduction of new business and technical services, enables seamless integration with in-house and third-party applications, and facilitates support for current and future payment components. These features combine not only to address today’s challenges, but also to create a modern payments platform to benefit from further technology and business advancements that will inevitably occur in the future. TANGO’s architecture deeply integrates with some of the modern and core fundamentals of HPE NonStop such as use of OSS and TMF-protected SQL/MX database, and full exploitation of HPE NonStop “process pair” feature through its hypervisor process. The dispatcher functionality works together with HPE NonStop TS/MP to provide scalability and availability, and supports the active/active configuration. This further establishes HPE NonStop as one of the most ideal platforms to run your TANGO payments solution. Be sure to check out our presentation on November 17th at 12:15 PM PST at the NonStop Technical Boot Camp or visit: lusispayments.com/onewebcast to schedule a one-on-one Zoom call. A TRULY INTEGRATED TRANSACTION PROCESSING ENGINE Lusis payments, the innovative provider of software and services to the payments industry, leads with TANGO, an online transaction processing engine for mission-critical 24x7 solutions including payments, retail, loyalty, finance, utilities, and transport. Payment processors across the globe rely on the total flexibility, high-performance processing, and built-in high availability of TANGO for acquiring, routing, switching, authenticating, and authorizing transactions across multiple channels, in a multi-institution environment across geographies. TANGO offers an open, integrated infrastructure that is highly scalable and efficient due to the genuine approach to SOA, which significantly reduces complexities and improves business responsiveness. With these attributes of TANGO, coupled with the fault-tolerance, near-linear scalability, and unmatched performance of HPE NonStop systems, the combined solution has been the go-to choice for many financial institutions (FIs) and payment processors to satisfy their mission-critical demands of highest efficiency and reliability. A COMPLETE PAYMENTS SOLUTION BUILT FOR THE FUTURE While payment processing is constantly evolving, the fundamentals have not changed—perform transactions at high speed with round-the-clock availability and absolute security. Changes come in the form of new financial services—how they are delivered and managed with increasing frequency. To keep pace in a dynamic industry and outperform competitors, you need modern, flexible solutions that help streamline new offerings. TANGO’s state-of-the-art technology and unparalleled configurability due to its microservices-based architecture foster creation of new business services rapidly, enable interoperability with in-house and third-party applications, and facilitate support for current and future payment components. And HPE NonStop is always adapting, such as hardware-independent HPE Virtualized NonStop in a VMware environment as well as support for rich tools for DevOps. Together, Lusis TANGO on HPE NonStop helps keep your payments processing environment at the forefront of financial services and customer experience. TANGO ARCHITECTURE—FLEXIBLE, OPEN, AND HIGHLY AVAILABLE A TANGO system is a set of services (SOA) implemented in multi-instance process modules and federated by the dispatcher (load-balancer) with communications facilitated via a universal data bus. The data bus provides a standard data format (Type/Length/Value [TLV]) for all messages exchanged between services. Hence, TANGO Payments Server has no restrictions on transaction types: both standard and nonstandard transactions can be easily defined in the system, as can new transaction types and message flows. This flexibility easily accommodates new requirements and integration of new payment opportunities including external services for fintech APIs. TANGO’s specialized high-availability components integrated within the platform provide an active/active systems integration without the need for third-party solutions. The active/active support within TANGO allows any given terminal to connect to any of the application servers to provide 24x7 availability to customers. And to further the advantages, TANGO’s architecture deeply integrates with some of the modern and core fundamentals of HPE NonStop such as use of OSS and TMF-protected SQL/MX database, and full exploitation of HPE NonStop “process pair” feature through its hypervisor process. The dispatcher functionality works together with HPE NonStop TS/MP to provide scalability and availability, and supports the active/active configuration. This further establishes HPE NonStop as one of the most ideal platforms to run your TANGO payments solution. READ THE ENTIRE ARTICLE

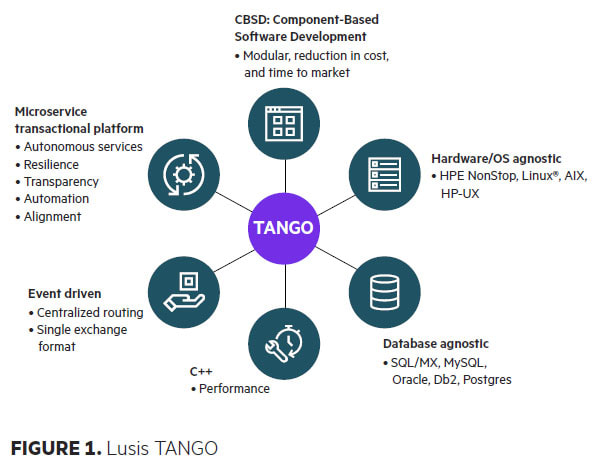

This article is an introduction to TANGO version 8, a major upgrade that provides full microservice integration and complete Cloud capacities. Introduction

Our broadly used Tango software is an implementation of a microservice architecture. Tango was not initially designed to be “microservice”, it was more properly designed to implement a transactional, mission critical, Service Oriented Architecture “that works” (SOATW!). By “that works” I mean, performant, scalable, avoiding contentions and anarchic leeway and sustainable. It is clear that to make it sustainable, a SOA system must include major concepts: a data bus or universal messaging layer to anarchy (meaning the ability to define as many interfaces than relations between services) and a load-balancer in order to avoid contentions or stress points. Some state that these 2 concepts are the key differences between SOA and microservice. However, the definition of microservice is not so clear and sometimes it is nothing more than: “it is not a monolithic architecture”. So, the first thing we will do is define it, then we will outline what applies and what does not apply in Tango and finally we will present Tango v8. What is a microservice architecture? A microservice application is a collection of autonomous services, each of them doing one thing well, and when combined, work together to provide a global service. Instead of a single complex system (monolithic architecture), the aim is to build and manage a set of relatively simple services that might interact in complex ways. These services collaborate with each other through a messaging protocol. The idea is quite simple. Having a collection of little ships instead of a huge one. That metaphor is not totally wrong. Lots of little ships are easy to maneuver, if one is delayed the others can progress. However, you can quickly cover more space with your multiple ships and if one is sunk (bad feature, bad design…) the others can still fight. Of course, there are some intrinsic difficulties: first a light fleet requires more coordination, second it is not as easy to make it a robust battleship. Anyway, microservices promise a better way to sustainably deliver business impact. Rather than a single monolithic unit, applications built using microservices are made up of loosely coupled, autonomous services. Building services that do one thing well avoids the inertia and entropy of large applications. Properties of microservices are:

Microservices applications scale by:

Five architectural principles structure microservices developments:

As mentioned above there are specific challenges and risks:

Tango. What we implement, what we do not. First, we at Lusis produce mission critical systems or applications that can’t fail. They must never lose a single transaction, never lose an order, never tolerate an outage, etc… This is not the standard world of the “web apps”. This is such an important difference that only those who are in the mission critical business can really understand it because failure of these mission critical systems could be the deciding factor between a managing director keeping their job or not. As with Lusis Tango, the HPE Nonstop was built on this same concept/mantra. Every component within the Nonstop framework is designed to never allow failure. Which is the reason why the HPE Nonstop has been the preferred hardware platform of choice for many large banks and financial institutions as well as other mission critical businesses for many years. Lusis Tango runs successfully on the HPE Nonstop. Lusis Payments has several customers realizing huge performance advantages running Lusis Tango on the HPE Nonstop. In addition, our systems are highly scalable and available which is imperative in the mission critical environment. Second, we are not realizing apps, projects or custom development. We are designing and developing a software that has to be economically competitive. This means for instance, that all development must look like the others, be written in the same way, with the same style, as we can’t afford “specialist developer” for this work. This is close to the CBSD model of development that I won’t expound upon here but to say it is fundamental in our development approach. Third, we provide an IT infrastructure that will last for many years into the future. So, it must be designed to live and scale, change, and mutate for 10, to 20 years or more. The infinity of an IT time scale. Therefore, we have some very specific requirements:

Having said that, a Tango application is clearly a collection of autonomous services, each of them doing one (or a few more) thing(s) well, that work together to provide a global service. They can be developed separately and deployed and run independently. A Tango application scales properly along the 3 axes that were mentioned above. As we are providing software in a restricted number of business spaces these services can be grouped in “families of services” that are doing the same kind of things at a conceptual level. It is important because each “family” or sub-family, have its own technique and set of libraries, tools, and ways to improve productivity. For instance, in a payment system, services types are:

The studying of the Susan Fowler’s book Production-Ready Microservices was very useful to us as it allowed us to review and audit our Tango architecture from the criteria for Production Readiness that she defines. The review concluded that a strong majority of these criteria were met (95%). When we were observing that Tango was not matching one of those criteria it was either by mistake or by a decision. In that case, it was worthwhile to evaluate if this decision was still valid. For instance, we were not interested in implementing the capacity for a Tango application to auto-create instances of services if the software was indicating there were not enough of them. For this reason: as we could not push the wall, or create CPU unit, it was useless or even negative to create new instances that would have further disturbed the machine and worsened the situation. Of course, this is no longer true with the Cloud capacities. From this review we deducted a list of Tango architecture features that constituted the base of the Tango Version 8 roadmap. Tango Version 8 We will limit the presentation to the two most important changes that are creating a true disruption considering Cloud capacity. Reviewing the “dispatcher” As mentioned above the Tango dispatcher oversees the technical routing and load-balancing. This is a very robust, very efficient (microseconds to process), multi-instanced service. However, mixing these two functionalities has some drawbacks: the routing context is in the dispatcher (timeout, multi-step rule, …), the dispatcher uses Tango events like a normal Tango service and therefore ,the dispatcher is not context free so can’t be easily “cloudified”. The dispatcher will be split into two parts:

When a Tango service sends an event (either a request or a notification), the destination is computed by applying the routing rules on the message. There are two cases:

When the destination service is local, the event is directly sent to the service using direct COM (a Tango process that knows each service composing it and can push directly the events inside a specific instance of a specific service), otherwise the message will be sent to the message router. The message router will not be a “Tango service”, it will use a lightweight Tango process and exchange messages using an optimized binary protocol not using standard Tango messaging. A typical event routing message will contain information about the sender, the target and the content. The message router will be completely agnostic about the message content, it will only use the routing data for delivery. The message router gathers the list of connected services all the services are connecting to all message routers and keep the connection alive like is done with the dispatcher using the self-registering feature and when an event must be routed it will choose the “best matching target”. Publish/Subscribe pattern has also been added for outgoing notifications:

Microservice self-monitoring This covers two new functionalities: ‘custom counters’ and ‘process/service auto-spawn’. Custom counters can be defined to monitor the processing time for specific events (usually only the request/response/notifications are monitored regardless of the kind of message). Now, a reference time can be defined for the event processing considered as a “normal” processing time for this kind of message for this microservice (ex: order creation on the OMS service). Processing time is computed in real-time and when the service begins to get “overwhelmed”. If the processing time increases over a defined limit, then alerts will be triggered and logged allowing the system to monitor the problem as soon as it occurs and locate the failure directly. Sometimes, the processing time may increase because the load is getting higher than usual (load peak) so the custom counters can also be linked to the “auto-spawn” feature. If defined inside the configuration, Tango will spawn automatically new instances of the microservice or process whenever the load is going over the predefined limit, allowing the Tango environment to automatically scale in function of the load. A new microservice will also be added gathering processing times and health status from all the other microservices, allowing centralized monitoring and provide real-time health status information about the environment to a dashboard. Full Cloud capabilities In conclusion:

Bibliography: Microservices – Microservices in action by Morgan Bruce, Paulo Pereira Microservices – Production-Ready Microservices by Susan J. Fowler CBSD – An Introduction to Component-Based Software Development by Kung-Kiu Lau, Simone di Cola Scalability – The Art of Scalability by Martin L. Abbott, Michael T. Fisher  Lusis sets to expand its presence in Mexico and select countries of Latin America. San Francisco & Paris — Lusis Payments, leading global innovator of mission-critical payments software and data science technology, is pleased to announce the newest addition to its sales executive team, Mercedes Fabila. Fabila joins the company as the Director of Sales, Mexico and Latin America. Lusis is best known for its TANGO solution, an online transaction processing engine for mission-critical 24x7 solutions including payments, retail, loyalty, finance, fraud, utilities, and transport. TANGO delivers performance, availability, and scalability, with a rich set of functionalities, all from a single architecture. TANGO is built on a highly performing micro-service architecture providing agile delivery for business needs. Lusis has also made significant advancements in Data Science, Artificial Intelligence, FX Trading, ISO 20022, Fraud and Blockchain. “I am extremely proud to be part of this great company and team. For these challenging times, organizations require innovation, faster implementations, more efficiency, and next-gen technology,” said Mercedes Fabila. An accomplished sales technology professional, Fabila has been in the NonStop payments industry for nearly thirty years with experience at Scotiabank, Banamex, Compaq and HPE among others. “We are very excited to be further expanding our presence in Mexico and select countries in Latin America,” said Brian Miller, Lusis General Manager. “Mercedes is a seasoned professional with an outstanding track record, and we are eager to work with her to provide the best technology solutions in the industry.” About Lusis Payments Lusis Payments is an innovative global software and services provider to the payments industry. The company’s proven, cutting edge technology operates in numerous hardware and operating environments. The TANGO platform, combined with the know-how to mitigate risk and deliver high levels of assured customer service, constitutes a unique proposition for organizations faced with the challenge of adapting to traditional and future needs in the payments ecosystem. |

lUSIS nEWSThe latest company and industry news from Lusis Payments. Archives

June 2024

Categories

All

|

RSS Feed

RSS Feed