|

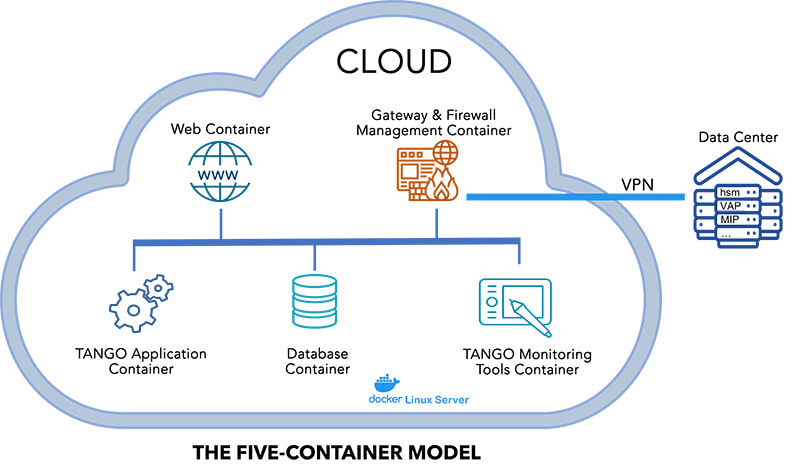

TANGO is the world's most performant Retail Payments solution with benchmark tests demonstrating 10,000 transactions per second. Built using a micro-services architecture, TANGO is also feature-rich and easily extensible. Backed by Lusis' proven track record it is not surprising that more and more organizations are swapping out their legacy payments infrastructure for TANGO. TANGO is the culmination of decades of crafted engineering that ensures the maximum operational performance and reliability as well as the most affordable cost of ownership. For example, TANGO includes a Self-Monitoring and Auto-Spawning feature whereby a suite of timers can be configured to monitor the processing time for specific events. By comparing the real-time measurements against the defined norms TANGO can immediately identify bottlenecks as soon as they occur. TANGO can also be configured to automatically spawn new instances of the affected micro-service or process thereby ensuring the required throughput is maintained. TANGO uses the Docker containerization platform and a typical deployment uses the 5-Container model shown below. Significantly, the container boundaries are defined to simplify manageability. For example, the gateways and firewalls are combined in a single container to simplify PCI certification tasks. Equally, the monitoring and other tools are located in a dedicated container to ease system evolution. This approach has numerous benefits, not least of which is that it is well proven and supports the easy and secure use of cloud infrastructure. However, in this model, container creation is still a manual process. Consequently, Lusis has expanded TANGO's container model to deliver the full elastic scalability advantages of a cloud-native environment.

“Do you take plastic?”

There was a time when consumers were asking that question in Retail outlets around the world. Nowadays, the ability to pay for goods and services with a debit or credit card is so commonplace that consumers simply assume that card acceptance is available virtually everywhere. It wasn’t always like this but several decades of investment has built the card payment infrastructure to its current state. However, despite the continued growth in consumer payment transactions, card payments does have its drawbacks. The level of fees paid by merchants has been a long standing area of contention, often resulting to protracted legal action to enforce greater billing transparency and reductions in overall fee costs. Another area of serious concern is the dramatic increase in card and account fraud, clearly aggravated by consumer behavior changes during the pandemic. Of course, the quest for ever simpler and more secure payment options is of great interest to many consumers. There has been a lot of payments innovation over the years including stored value cards, digital wallets, and bio-metric authentication. However, many of these schemes piggyback on the card infrastructure or achieve only limited levels of success. In most industries technology has been reinventing itself at accelerating rates but this is not the case with card payments. This begs the question – “Is the card itself the bottleneck to change?” Putting aside the entire settlement cycle there are several key elements that a truly alternative consumer payments option needs to address. Firstly, the consumer needs to have some form of payment token and authentication method. Additionally, the alternate payment scheme needs to ensure the secure acquisition and routing of the payment to the appropriate institution for authorization. The advent of smartphones and wearable computing, coupled with the growth of real time account to account payments is already proving to be an interesting possible alternative to card payments. Some adoption rate projections suggest that account-based payments could notionally obsolete card-based payments. It seems that the real hurdle to obsoleting card payments is a commercial issue, not a technical one. As long as the new entrants into the consumer payments market all seek their own “magic bullet” then they are most likely to be left nibbling around the market share of the traditional card brands. The last thing consumers want is to be drip-fed an endless array of different payment options with no clear indication of convergence and interoperability. The electric car market provides a great comparison in this regard. In an age of climate change and excessive wastage it seems obvious that governments should demand all electric cars sold in their country to have the same charging connection. The cost and timescales to create an effective charging stations infrastructure is immediately reduced, and consumers would have greater confidence to switch to electric cars. I have no doubt that were the governments of a few of the major market countries to take this bold step it would be universally applauded and the card manufacturers would deliver the requisite standards in a heart beat. The US market saw a strong consortium of banks cooperate in the launch of Zelle as a competitive counter to Venmo. However, the really big question is whether the banks, Fintechs, and Retailers can cooperate to deliver a single, ubiquitous consumer payments option that can move us beyond the 70 years history of plastic cards. Meet Dave Smith, Payments Specialist with Lusis Payments’ European team.  Q: Let’s kick off with a direct question - the payments, and more broadly the financial sector, is facing a myriad of challenges, would you say you’re optimistic about what the future holds? Dave: Definitely. I’ve been in the financial sector for a long time, and I’ve seen waves of economic, social and technology events that all threaten to completely rock the sector. But this is an incredibly resilient industry - one of the pioneers of technology in business. We’re at our best when we’re putting customers first, developing products that help them in their lives, and enabling the global economy to function - payments are central to that. That makes me very optimistic about the future of payments - powered by technology. At the end of the day, payments are at the heart of the way we live, and that makes them central to an organisation’s reputation. Q: You say that payments are at the heart of the way we live, do you think banks recognise that enough as they look for new revenues and business models? Dave: There can be a mindset within banks that see payments as a commodity or utility. I think that’s a big mistake, because if you take payments away then the rest of the banking infrastructure loses a sense of purpose. Banks can sometimes see it more as a chore that the central bank makes them handle than what it really is - a direct connection to the customer. That’s when they run the risk out trying to outsource it to another institution. Big mistake. Consumers want banks to handle payments. It’s one of the most trusted aspects of banking - that you help me move my money, pay my mortgage, get cash out or buy goods and services. The trick is to turn that into an effective business model, which, with the right infrastructure, is very achievable for almost every financial services institution out there today. Q: What challenges do you see banks facing in terms of their business models? Dave: There was a massive acceleration pre-pandemic of online only banking - not just the challengers we see in the UK and Europe, but also traditional banks who would offer you an extra half a percent of interest in order to bank online and not use a branch. So managing a physical footprint is certainly on the list. On top of that, you have a new generation of consumers who will live very differently than those before. More subscription services and less ownership, more renting homes and less buying. That has a knock on effect for the range of other financial services products banks typically facilitate - from mortgages to insurance. There has been a continued depression of interest rates which means the classic business model of banks taking and lending money is more difficult than before. On the other hand, transaction volumes have gone up hugely in the pandemic. However, banks haven’t necessarily been the quickest to respond with new products and services (and I include challengers in that too to a certain extent), in part because of regulation but also because they didn’t have the right infrastructure in place to move rapidly. Q: What role do you think regulators do, and should, play in the development of payments going forwards? Dave: Regulations can create opportunity for the financial services sector, often in how they govern consumer service levels. Faster Payments is a great example of that - people want to get their money instantly (and in a 24/7 world why would they not!) and so it helps focus technology and innovation on meeting those wants and needs. Q: What’s the big infrastructure challenge that’s holding banks back from seizing these opportunities? Dave: At the end of the day, too many financial institutions are using technology that is seriously outdated, and wasn’t built for the range of scenarios that we see now. Challenger banks that only came onto the market a few years ago are already rebuilding their infrastructure, so it makes no sense that you’d have a big name bank that’s using technology someone purchased in the 70s or 80s to run significant parts of their systems. The name of the game is flexibility. You need to put infrastructure in place that can survive any unknown scenario. No one in banking predicted the challenges that 2020 would bring - but too often they only build technology that copes with the scenarios they know about. Banks need a new approach - they need to build for uncertainty, for flexibility and for an unknown future. Then you get resilience. Whether they rip and replace, or take a bit-by-bit approach, is completely down to their needs, but something needs to change. Quickly.

We’ve launched a new whitepaper on preparing your payments infrastructure for the next decade. Head to our Market Insights page to download the whitepaper, and find out what’s changing in the European payments landscape, How failure to adapt became the biggest infrastructure risk facing payments businesses, and how you can design a payments infrastructure that allows you to reduce risks and quickly bring new products and services to market.  Many financial services companies today are operating on technology stacks that aren’t up to the challenge of today’s market. Some banks are even operationally dependent on technology that was installed in the 70s or 80s. Global growth and opening up of economies will help the payments sector thrive again post-pandemic, but it’s only those with the right infrastructure in place who will be able to seize these opportunities. It’s become a cliche, but the pandemic has accelerated a decade’s worth of change into just a few short years. While the core infrastructure helped banks keep on top of the day to day challenges in the pandemic, many senior teams will be left wondering what they could have done differently had there been better infrastructure in place. Customers needed new and different types of products more than ever. They needed protection from increased online fraud. Businesses needed to change how they operated and collected payments. In general, banks were positioned to survive, not thrive going into the pandemic. That could cost them customer loyalty, and ultimately revenue if left unchanged. Part of the challenge is that creating and buying payments infrastructure is a big decision - it’s the engine room of your bank’s operations. That can make it all too easy to stick your head in the sand and leave changing it as a decision for another day. But that only creates bigger and bigger problems down the road. Eventually your current infrastructure will meet a challenge it can’t handle - and you’ll end up with bad headlines and an appointment with the regulator. What do my customers expect and what’s my business model? When faced with social changes, a raft of digital-first competitors, and regulatory pressures, understanding your positioning in the market landscape is critical. The financial institutions need to figure out how they can appeal to new consumer expectations, and turn them into a sustainable revenue stream. The success of this generation of banks has been fueled by changing expectations of a new generation of end-users. With more trust placed in the internet, digital only offerings have been able to flourish. Banks are facing pressures on their business models. Many are struggling to make money the way they used to, with pressure from falling interest rates, current account revenues, managing branch footprints and loan losses amongst others. On top of that, new regulations like the European Payments Initiative means technology must be geared towards adapting to the new challenges and opportunities created. Follow Five Key Principles for Decision Making

The payments industry in Europe is facing an unprecedented set of challenges, and the speed of change makes this more pressing than ever before. The challenge facing the industry isn’t whether we understand the technical barriers, but instead whether financial institutions are able to execute the right technology strategy to meet market needs. Customers need new and different types of products more than ever. The risk is that CTOs, boards and other senior leadership teams fall into a false sense of security that could prove fatal.

|

lUSIS nEWSThe latest company and industry news from Lusis Payments. Archives

June 2024

Categories

All

|

RSS Feed

RSS Feed