|

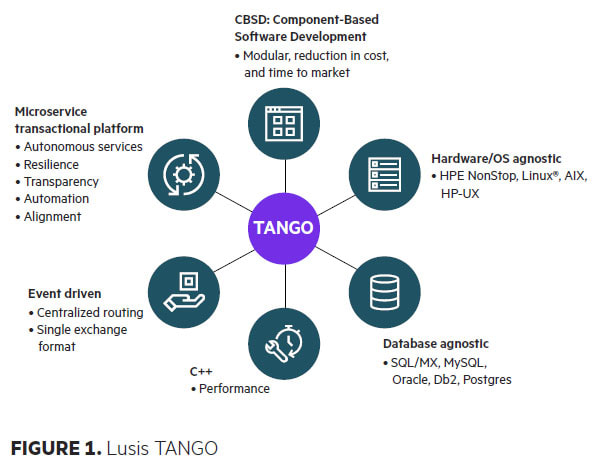

A TRULY INTEGRATED TRANSACTION PROCESSING ENGINE Lusis payments, the innovative provider of software and services to the payments industry, leads with TANGO, an online transaction processing engine for mission-critical 24x7 solutions including payments, retail, loyalty, finance, utilities, and transport. Payment processors across the globe rely on the total flexibility, high-performance processing, and built-in high availability of TANGO for acquiring, routing, switching, authenticating, and authorizing transactions across multiple channels, in a multi-institution environment across geographies. TANGO offers an open, integrated infrastructure that is highly scalable and efficient due to the genuine approach to SOA, which significantly reduces complexities and improves business responsiveness. With these attributes of TANGO, coupled with the fault-tolerance, near-linear scalability, and unmatched performance of HPE NonStop systems, the combined solution has been the go-to choice for many financial institutions (FIs) and payment processors to satisfy their mission-critical demands of highest efficiency and reliability. A COMPLETE PAYMENTS SOLUTION BUILT FOR THE FUTURE While payment processing is constantly evolving, the fundamentals have not changed—perform transactions at high speed with round-the-clock availability and absolute security. Changes come in the form of new financial services—how they are delivered and managed with increasing frequency. To keep pace in a dynamic industry and outperform competitors, you need modern, flexible solutions that help streamline new offerings. TANGO’s state-of-the-art technology and unparalleled configurability due to its microservices-based architecture foster creation of new business services rapidly, enable interoperability with in-house and third-party applications, and facilitate support for current and future payment components. And HPE NonStop is always adapting, such as hardware-independent HPE Virtualized NonStop in a VMware environment as well as support for rich tools for DevOps. Together, Lusis TANGO on HPE NonStop helps keep your payments processing environment at the forefront of financial services and customer experience. TANGO ARCHITECTURE—FLEXIBLE, OPEN, AND HIGHLY AVAILABLE A TANGO system is a set of services (SOA) implemented in multi-instance process modules and federated by the dispatcher (load-balancer) with communications facilitated via a universal data bus. The data bus provides a standard data format (Type/Length/Value [TLV]) for all messages exchanged between services. Hence, TANGO Payments Server has no restrictions on transaction types: both standard and nonstandard transactions can be easily defined in the system, as can new transaction types and message flows. This flexibility easily accommodates new requirements and integration of new payment opportunities including external services for fintech APIs. TANGO’s specialized high-availability components integrated within the platform provide an active/active systems integration without the need for third-party solutions. The active/active support within TANGO allows any given terminal to connect to any of the application servers to provide 24x7 availability to customers. And to further the advantages, TANGO’s architecture deeply integrates with some of the modern and core fundamentals of HPE NonStop such as use of OSS and TMF-protected SQL/MX database, and full exploitation of HPE NonStop “process pair” feature through its hypervisor process. The dispatcher functionality works together with HPE NonStop TS/MP to provide scalability and availability, and supports the active/active configuration. This further establishes HPE NonStop as one of the most ideal platforms to run your TANGO payments solution. READ THE ENTIRE ARTICLE

Romain Soubeyran, Managing Director of CentraleSupélec and Philippe Préval, Managing Director of Lusis, launch the Chair "Artificial intelligence applied to the detection of payment fraud and trading". Through this partnership, Lusis and CentraleSupélec are strengthening their collaboration in the field of artificial intelligence applied to the banking sector. Lusis is the publisher of TANGO, a high-performance payments transaction platform for the finance industry. With the TANGO platform, Lusis provides a complete retail payment system that includes fraud detection, as well as extremely rich and complex “front to back” trading platforms.

In order to give a formal framework to this permanent R&D approach, in June 2017 Lusis created an Artificial Intelligence department responsible for working on Machine Learning / Deep Learning approaches mainly applicable to fraud detection on payments and trading strategies in the financial markets. For its part, CentraleSupélec gives very high priority to artificial intelligence by dedicating focus to a of 3rd year to AI. The laboratories of CentraleSupélec are also present in this field by participating in numerous projects. This chair is the first signed by CentraleSupélec with a French high tech SME. Strong involvement of students and researchers Thanks to the long-standing collaboration between Lusis and CentraleSupélec, the student-engineers of the School have the opportunity to carry out, within the framework of "industrial study contracts" (« contrats d’étude industrielle » CEI), projects that focus on solving complex problems using statistical or machine learning approaches. Involving students allows Lusis to generate and capture new ideas created in the laboratory that are usable in industrial approaches, and to access a pool of skills (researchers, students and collaboration network) conducive to the development of the various projects carried out. Scientific objectives and research themes The Chair supported by Lusis and CentraleSupélec provides a structured working framework allowing the two partners to carry out research work of specific interest by relying on a dedicated research team. It is housed in the Computer Science Research Laboratory (LRI), a joint research unit at Paris-Saclay University, CNRS and CentraleSupélec. The themes studied include the detection of fraud on payments and trading strategies. As far as fraud detection is concerned, the essential points to take into account are both the appearance of new fraud strategies and the essentially online nature of the process, as well as the ability to provide an explanation for the refusal or the acceptance of a transaction. With regard to trading strategies, the work undertaken highlights the share of random time series in financial market data. This is the major difficulty of research in this area. "Artificial intelligence is a game changer in the world of IT and business in general. It will completely redraw the landscape of whole sections of the industry. We want Lusis to be part of this revolution, particularly in our preferred areas of trading, payments systems, on-line banking, and customer-centric programs. For us, being an AI player means being a stakeholder in AI research. This is why, we are both happy and proud to be able to give a new dimension to our long-standing partnership with CentraleSupélec. Our teams like those set up by CentraleSupélec are enthusiastic about exploring these new universes,” declares Philippe Préval, CEO of LUSIS. “Artificial intelligence is a young science whose recent successes and advances open up enormous potential for innovation in all fields and sectors of activity, which is at the heart of CentraleSupélec's strategy. We train, through dedicated courses, the engineers and researchers who will build tomorrow's intelligent systems at the service of society. With a wide disciplinary variety, our research activities cover a wide spectrum of AI," says Romain Soubeyran, Managing Director of CentraleSupélec who adds"The artificial intelligence chair applied to the detection of payment fraud and trading with LUSIS allows us to reinforce this strategy with a very ambitious scientific program.” About CentraleSupélec CentraleSupélec is a public scientific, cultural and professional establishment, born in January 2015 of the merger of École Centrale Paris and Supélec. Today, CentraleSupélec consists of 3 campuses in France (Paris-Saclay, Metz and Rennes). It has 4,300 students, including 3200 engineering students, and brings together 16 laboratories or research teams. strongly internationalized (30% of its students and almost a quarter of its international teaching staff), the school has established over 170 partnerships with the best institutions in the world. Leading school in higher education and research, CentraleSupélec is a benchmark center in the field of engineering and systems sciences, ranked among the best institutions world. It is a founding member of Paris-Saclay University and chairs the Groupe des Ecoles Centrale (Lyon, Lille, Nantes and Marseille), which operates international establishments (Beijing (China), Hyderabad (India), Casablanca (Morocco)). www.centralesupelec.fr About Lusis Lusis is a technology supplier allowing to implement solutions of: • Payment HUB • Trading • Advanced messaging • Fight against fraud Lusis payments is a major player in the payments world. We focus on R&D, innovation, performance, time to market, disruption. We take advantage of SCRUM both for our developments and for the projects we carry out with our customers. The architecture of our micro-service (Tango) solution and benefits from a constant investment of R&D on new payments, AI, distributed ledgers, performance. We have clients all over the world, operating directly or through partnerships from: • Paris: HQ, R&D • London: EMEAA Sales • San Francisco: America’s sales

A FEATURED ARTICLE ON ATM MARKETPLACE by Philippe Préval, CEO, Lusis Payments Banks at a Crossroads Although cash delivery activity seems to be decreasing due to contactless payments and wallets, in North America, the Automated Teller Machine (ATM) channel is still maintaining its central role as a core banking touchpoint with the consumer. It has become an integral part of the banking omni-channel experience, not only playing a key role in the broad context of modern banking but also being a major enabler of mission-critical “access to funds” functionality within financial inclusion initiatives. The channel is taking an even more important role as branch network optimization leads to a reduction in the number of branches while consumers still express a preference for banks with a physical presence. On the other side of the ocean, some European major companies seem to see the ATM business as a dying activity that can be easily outsourced to service providers that provide a low cost/poor user experience. So, who is on the right path between these two radically different approaches? New features that are coming in front-line for ATMs may be giving evidence of a really interesting future for those teller machines putting the truth on the United States’ (US) side. Banks’ Initiatives There are interesting initiatives related to activation of classical cash functions using contactless devices, including Smartphones. New functions for providing cash to one individual using his or her Smartphone are already very popular in the US and totally marginal in Europe. There are two ways of delivering cash to someone: 1) Using a Smartphone Radio-frequency identification (RFID) capacity and wallet to allow a customer to retrieve cash from an ATM, there is a wallet Device Primary Account Number (DPAN) used in place of a card. DPAN is also known as the Digital Primary Account Number. Once the wallet is authenticated, even the on-us transactions are available for the user. On-us transactions are those for which all transactions for an ATM or a Point of Sale (POS) machine originate from the same bank. The only condition is to re-authenticate the wallet every time the user chooses a function. 2) Cash can be sent to a third-party holder using wallets. An ATM is then used to dispense cash to the destination user. Some ATM Vendors´ Initiatives Following is a brief discussion of two interesting initiatives proposed by the two market leaders. NCR Corporation’s ITM The NCR ITM (Interactive Teller Machine) is an Assisted Service hardware solution. It has the same footprint as an NCR Self Service ATM system but has integrated two-way video conferencing with additional software and hardware to support live interaction with a remote teller. The NCR ITM includes audio capabilities beyond a typical ATM, as well as incorporates peripherals to support the member experience like a phone handset for privacy or a signature pad to require customers to sign for certain activities. The ITM can be supported as a stand-alone video teller solution. Diebold ILT The In-Lobby Teller (ILT) is offering Branch services without a real Branch and tellers or inside a Branch but with fewer teller agents. It is an innovative solution that redefines the Branch experience for both the bank and its customers. The ILT bridges the gap between the teller and the ATM by combining the convenience and accuracy of a machine with the natural and personal interaction of a human. All operations that a customer can do in a Branch are available, including deposit, withdrawal and all home banking functions. A dramatic productivity increase is anticipated with ILT, with one teller being able to pilot the dialog of several ILT in various locations. All these new channels use modern JavaScript Object Notation (JSON) web services to carry the transactions’ information to the payment system that manages the ITM, ILT. Working together. Accelerating results.

|

lUSIS nEWSThe latest company and industry news from Lusis Payments. Archives

June 2024

Categories

All

|

RSS Feed

RSS Feed