I recently read a BBC news article that noted the German cyber-security authority had warned against using the Kaspersky anti-virus software. Among other things it stated “Russian information technology businesses could be spied on or forced to launch cyber attacks.” Perhaps the easiest response would be to simply shrug this off. However, Putin’s illegal war against Ukraine and his alarming threats against Russian citizens with Western sympathies casts a cautious shadow over dependencies on mission-critical Russian software systems. In addition to cyber security software and networking, I wonder about payments systems – are these at risk? Payments systems carry sensitive card details and customer information and significant damage can result from compromised payments infrastructure. Hopefully this is all just plausible speculation but it highlights the fact that once trust has gone, fear sets in, and uncertainties multiply. And trust it seems, is a diminishing commodity. #cybersecurity #payments #infrastructure #software #security By Fabrice Daniel, Artificial Intelligence Department of Lusis, Paris, France http://www.lusisai.com ABSTRACT

Combining evidence from different sources can be achieved with Bayesian or Dempster-Shafer methods. The first re-quires an estimate of the priors and likelihoods while the second only needs an estimate of the posterior probabilities and enables reasoning with uncertain information due to imprecision of the sources and with the degree of conflict between them. This paper describes the two methods and how they can be applied to the estimation of a global score in the context of fraud detection. INTRODUCTION Fraud detection mainly relies on expert driven methods that implement a set of rules and data driven approaches implementing machine learning (ML) models. Both provide an estimate (or a score) for a new transaction to be fraudulent. While each ML model naturally returns a fraud probability, the experts can also attach a probability to each rule. They can also be automatically calculated from the labeled his-tory. Combining them together produces a global score that can be used in a near real time system to rank a set of trans-actions having the highest probability to be fraudulent. By obtaining this ranking, investigators can concentrate their efforts on the suspect transactions with the highest probability of being true frauds. The most common approaches for combining scores are summing individual scores or returning the highest score among the trigged rules. This is not entirely satisfactory given that summing scores is equivalent to averaging the probabilities returned by each predictor (rule or model). It also does not take into account the uncertainty of each predictor and the degree of conflict between them. For the Lusis fraud system, we work on implementing more appropriate approaches. This paper proposes two ways for addressing this problem. The first is to use Bayesian methods [5]; the second is to combine the scores by using Dempster-Shafer theory [6].

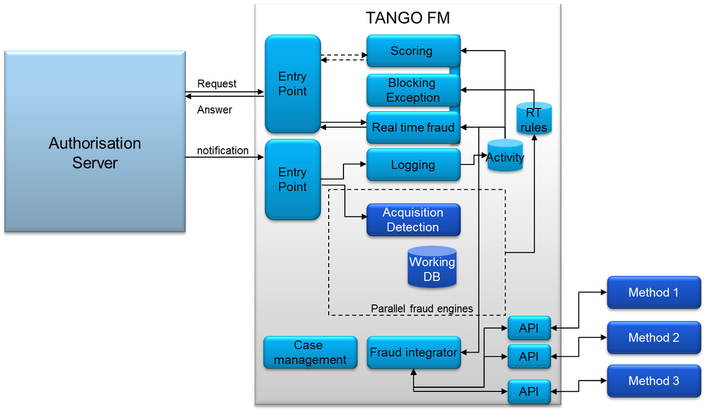

Romain Soubeyran, Managing Director of CentraleSupélec and Philippe Préval, Managing Director of Lusis, launch the Chair "Artificial intelligence applied to the detection of payment fraud and trading". Through this partnership, Lusis and CentraleSupélec are strengthening their collaboration in the field of artificial intelligence applied to the banking sector. Lusis is the publisher of TANGO, a high-performance payments transaction platform for the finance industry. With the TANGO platform, Lusis provides a complete retail payment system that includes fraud detection, as well as extremely rich and complex “front to back” trading platforms.

In order to give a formal framework to this permanent R&D approach, in June 2017 Lusis created an Artificial Intelligence department responsible for working on Machine Learning / Deep Learning approaches mainly applicable to fraud detection on payments and trading strategies in the financial markets. For its part, CentraleSupélec gives very high priority to artificial intelligence by dedicating focus to a of 3rd year to AI. The laboratories of CentraleSupélec are also present in this field by participating in numerous projects. This chair is the first signed by CentraleSupélec with a French high tech SME. Strong involvement of students and researchers Thanks to the long-standing collaboration between Lusis and CentraleSupélec, the student-engineers of the School have the opportunity to carry out, within the framework of "industrial study contracts" (« contrats d’étude industrielle » CEI), projects that focus on solving complex problems using statistical or machine learning approaches. Involving students allows Lusis to generate and capture new ideas created in the laboratory that are usable in industrial approaches, and to access a pool of skills (researchers, students and collaboration network) conducive to the development of the various projects carried out. Scientific objectives and research themes The Chair supported by Lusis and CentraleSupélec provides a structured working framework allowing the two partners to carry out research work of specific interest by relying on a dedicated research team. It is housed in the Computer Science Research Laboratory (LRI), a joint research unit at Paris-Saclay University, CNRS and CentraleSupélec. The themes studied include the detection of fraud on payments and trading strategies. As far as fraud detection is concerned, the essential points to take into account are both the appearance of new fraud strategies and the essentially online nature of the process, as well as the ability to provide an explanation for the refusal or the acceptance of a transaction. With regard to trading strategies, the work undertaken highlights the share of random time series in financial market data. This is the major difficulty of research in this area. "Artificial intelligence is a game changer in the world of IT and business in general. It will completely redraw the landscape of whole sections of the industry. We want Lusis to be part of this revolution, particularly in our preferred areas of trading, payments systems, on-line banking, and customer-centric programs. For us, being an AI player means being a stakeholder in AI research. This is why, we are both happy and proud to be able to give a new dimension to our long-standing partnership with CentraleSupélec. Our teams like those set up by CentraleSupélec are enthusiastic about exploring these new universes,” declares Philippe Préval, CEO of LUSIS. “Artificial intelligence is a young science whose recent successes and advances open up enormous potential for innovation in all fields and sectors of activity, which is at the heart of CentraleSupélec's strategy. We train, through dedicated courses, the engineers and researchers who will build tomorrow's intelligent systems at the service of society. With a wide disciplinary variety, our research activities cover a wide spectrum of AI," says Romain Soubeyran, Managing Director of CentraleSupélec who adds"The artificial intelligence chair applied to the detection of payment fraud and trading with LUSIS allows us to reinforce this strategy with a very ambitious scientific program.” About CentraleSupélec CentraleSupélec is a public scientific, cultural and professional establishment, born in January 2015 of the merger of École Centrale Paris and Supélec. Today, CentraleSupélec consists of 3 campuses in France (Paris-Saclay, Metz and Rennes). It has 4,300 students, including 3200 engineering students, and brings together 16 laboratories or research teams. strongly internationalized (30% of its students and almost a quarter of its international teaching staff), the school has established over 170 partnerships with the best institutions in the world. Leading school in higher education and research, CentraleSupélec is a benchmark center in the field of engineering and systems sciences, ranked among the best institutions world. It is a founding member of Paris-Saclay University and chairs the Groupe des Ecoles Centrale (Lyon, Lille, Nantes and Marseille), which operates international establishments (Beijing (China), Hyderabad (India), Casablanca (Morocco)). www.centralesupelec.fr About Lusis Lusis is a technology supplier allowing to implement solutions of: • Payment HUB • Trading • Advanced messaging • Fight against fraud Lusis payments is a major player in the payments world. We focus on R&D, innovation, performance, time to market, disruption. We take advantage of SCRUM both for our developments and for the projects we carry out with our customers. The architecture of our micro-service (Tango) solution and benefits from a constant investment of R&D on new payments, AI, distributed ledgers, performance. We have clients all over the world, operating directly or through partnerships from: • Paris: HQ, R&D • London: EMEAA Sales • San Francisco: America’s sales Lusis TANGO embeds an anti-fraud service that has been successfully implemented by several large French banks for many years. This service can be provided as an independent TANGO environment application. List of features:

|

lUSIS nEWSThe latest company and industry news from Lusis Payments. Archives

June 2024

Categories

All

|

RSS Feed

RSS Feed